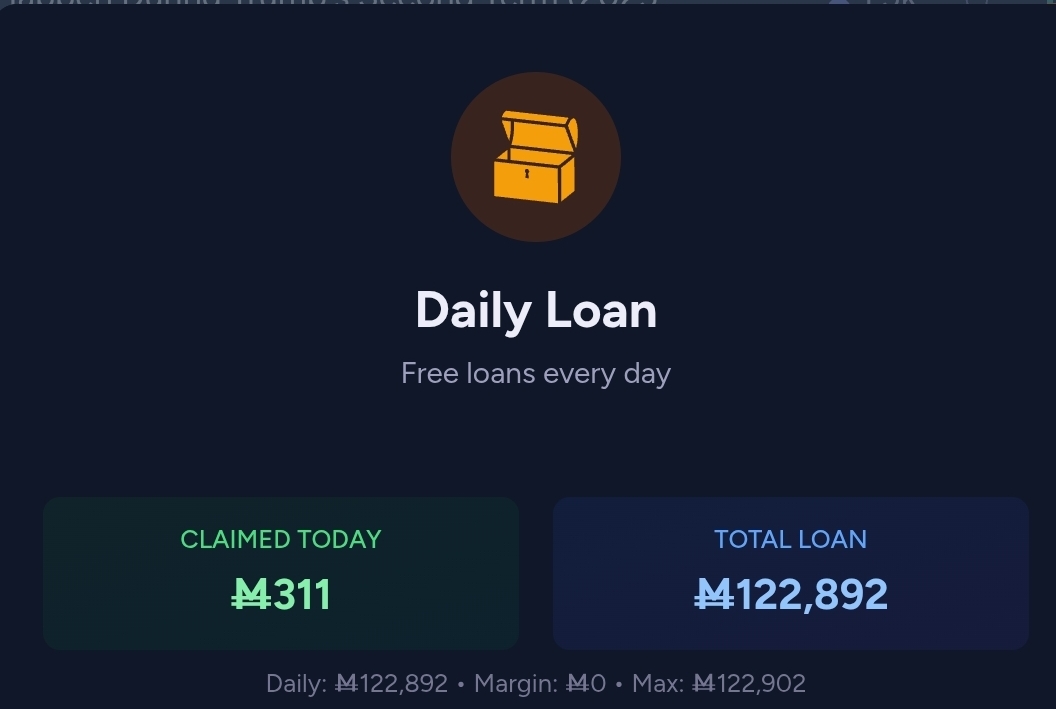

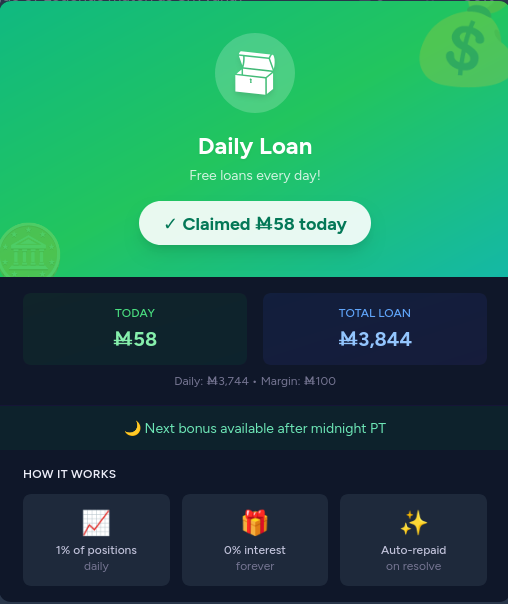

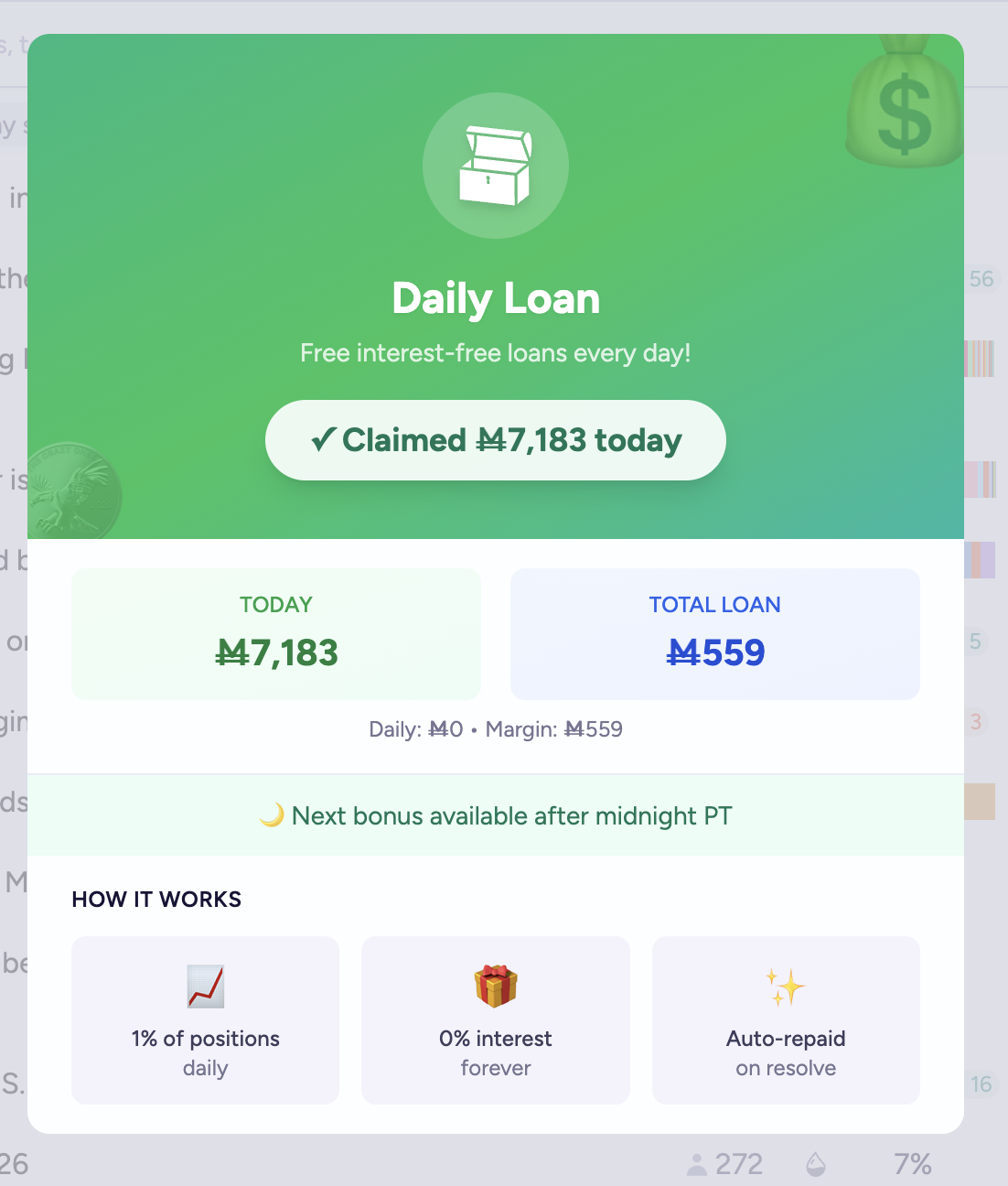

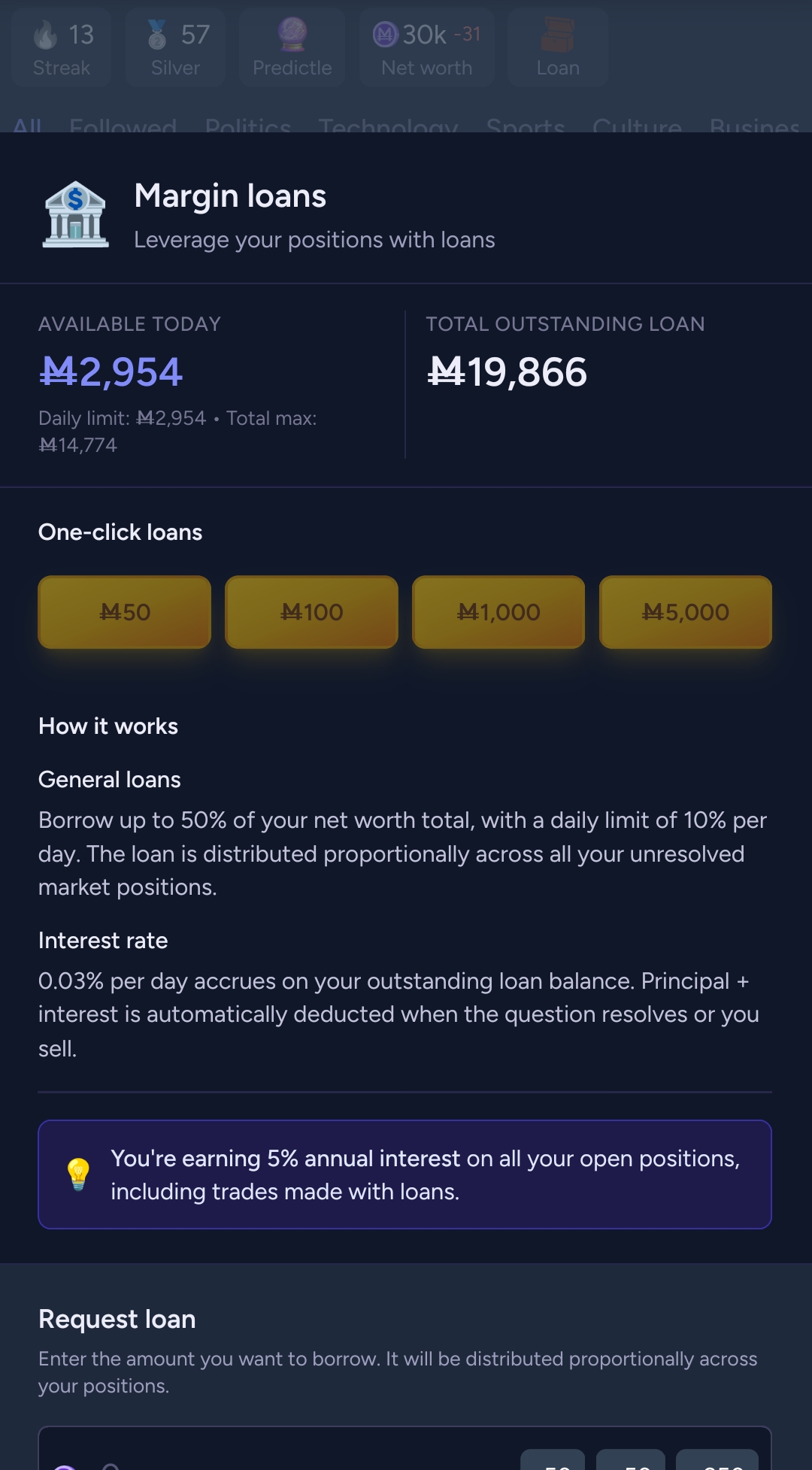

Manifold has ̶r̶e̶p̶l̶a̶c̶e̶d̶ augmented the Daily Loan with a full-fledged margin trading system. These changes make it easier than ever to access mana trading capital.

Margin trading

Users can access margin loans at any time to borrow mana to trade with from your user profile

Margin loans can be paid back at any time.

The maximum loan amount is equal to 100% of a users net worth (previously 50%).

Users are limited to claiming no more than 10% of their net worth in loans per day.

Loans on specific markets are capped at 5% of the user's net worth.

Markets must be listed, ranked, and actively traded to be eligible for new margin loans.

Margin loans accrue interest at the rate of 0.03% per day. Trades made using loans are eligible for the 5% annual interest payments. So, the net financing for leveraged positions is ~5% per year.

Previous interest-free loans have been fully grandfathered in and will not accrue any fees going forward.

Update: We've removed interest payments again.

5% annual interest is less necessary with daily loans back.

Users were abusing the system more than expected to create fake markets to capture interest payments.

Interest is less salient / exciting to users than other ways we could promote the platform for the equivalent amounts of mana inflation.

The ideal UX would be paying out interest payments on unresolved markets in mana daily. But paying out interest in mana is exploitable. Paying out interest in shares is doable but is much worse UX that makes the platform more confusing.

It is very likely in the coming week we will make more tweaks to the loan system. This document will be continue to be updated. Stay tuned!

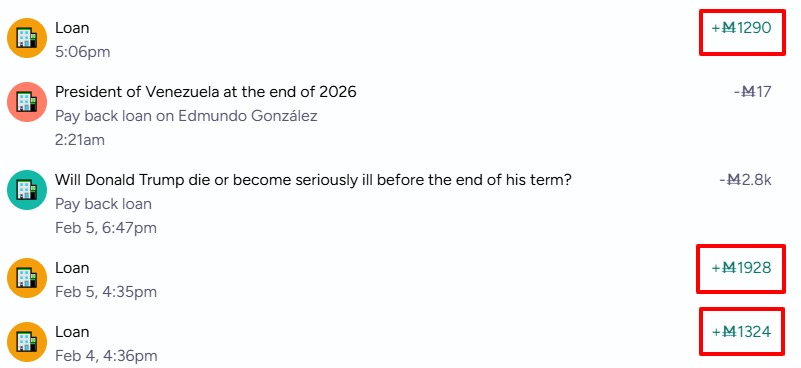

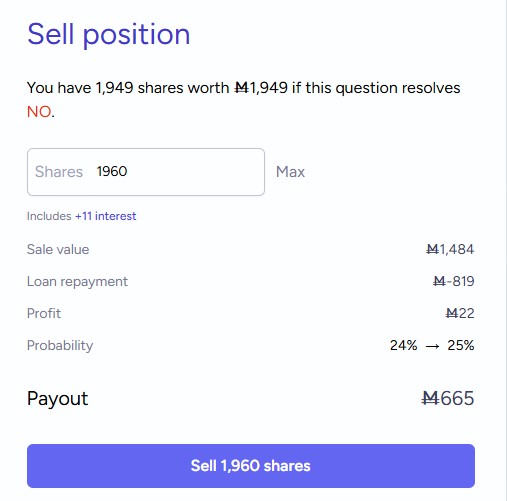

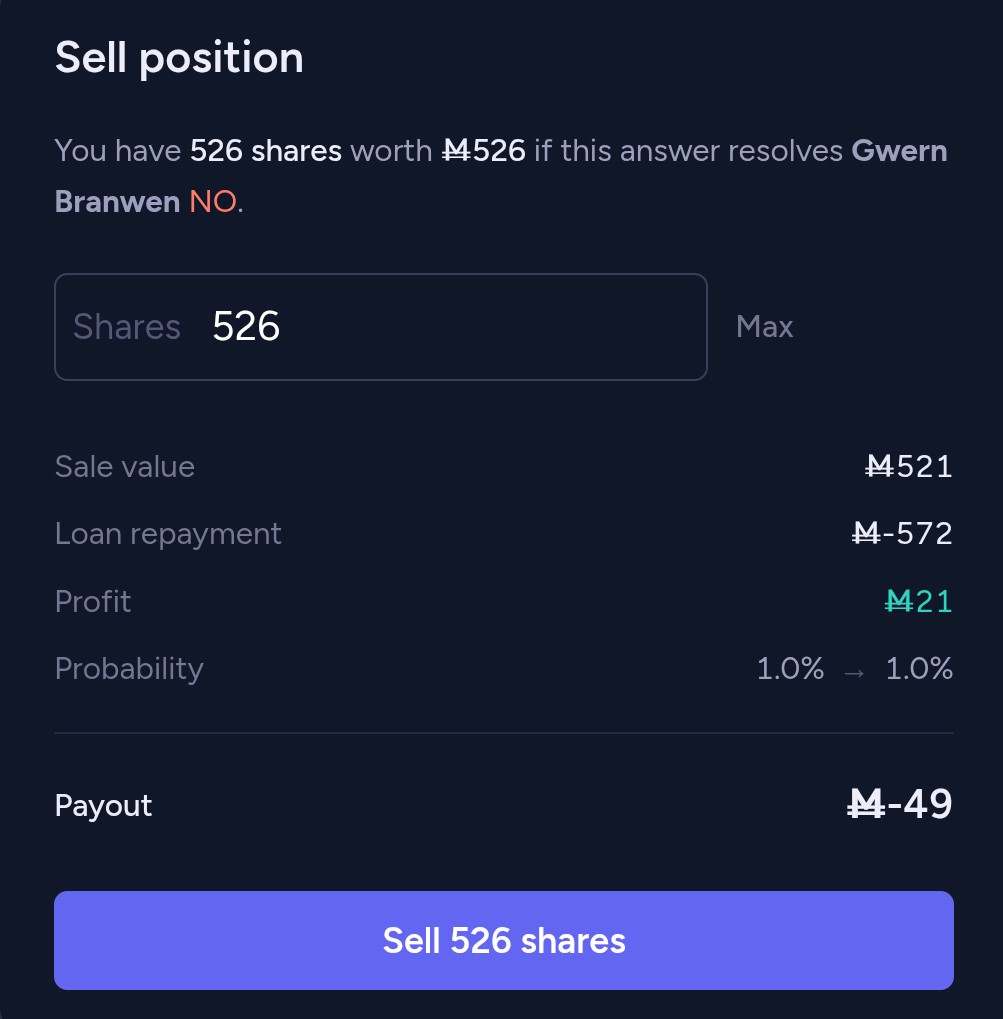

@SG The free loans were always advertized with "everything works automatically". I never took any other kind of loans. Now explain how this could happen:

@Primer the market price moved, your position became less valuable, and now the same loan is underwater

@Robincvgr No, look more closely. I didn't buy high and try to sell low. I'm holding No shares! I have 526 shares, those are worth 521 Mana right now. Their value is as close to their max possible value as it gets. I have a profit of 25 Mana.

@Emanuele1000 It's the sum of your loan from individual markets. I think the individual market loan is now 1% of cost basis (spent) or expected value, whichever is lower. I can't check it at the moment because I'm capped. Maybe they could add the "daily loan increment" to the column selector.

edit: this is wrong

@travis But 183.6(00) is not 197.384. And I certainly didn't buy almost 14,000 M “today,” whatever today means (I made a large purchase, but it was later, in fact, I now have 210,000 in portfolio value).

The only thing that comes to mind is that there is a limit per market (not specified) and there are approximately 14,000M “shares” for which I have already requested the maximum loan....

@Emanuele1000 It looks like they updated the FAQ: https://docs.manifold.markets/faq#what-are-loans

I think it's 1-3% (based on your tier) of expected value but subject to all of the following restrictions:

more than 10 traders

more than 24 hours old

not unranked or unlisted

loan is less than cost basis

loan is less than expected value (not sure?)

loan is less than 5% of overall equity

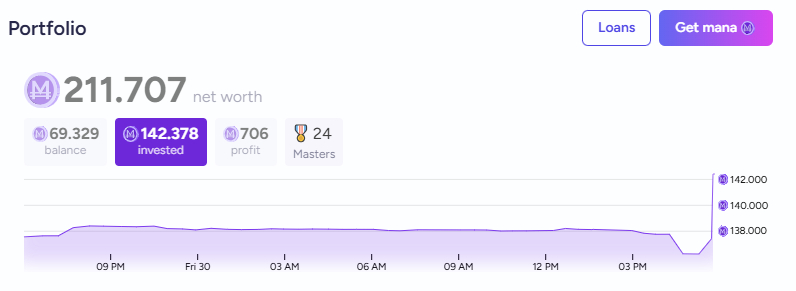

Equity is the "invested" number on your account page, it's share value - loans (or net worth - balance).

As @AnonUser pointed out below, if you have a large position that is loan-capped by cost basis (because the probability moved in your favor), you can reset your cost basis by finding someone to buy all your shares and sell them back at the current price. However, it will reset your loan to 0.

@travis Ah, so there are yet more limitations, unnecessary friction that only complicates everything and makes it impossible not only to create a game strategy, but even to understand what the point of it all is.

"Free loan per-position limit: Free loans are also capped at your cost basis (invested amount) per position"

What's the point? Not only is it enough to buy and resell, so it only blocks illiquid markets, but it doesn't make sense in itself.

I imagine someone spending 1000M on a candidate in the upcoming 2028 elections, who is now trading low. He actually runs and is quite successful, his chances increasing from 1% to 10%. Why couldn't the user ask for a loan 10 times greater? It's an incentive to sell and cash in, not to bet on long markets.

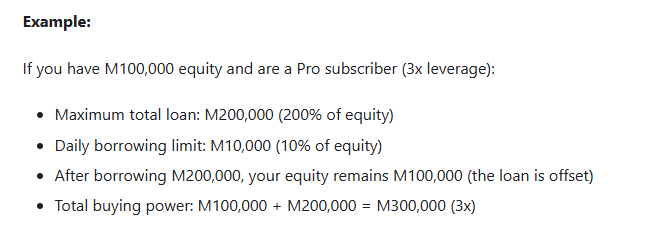

That example is wrong. If I have equity of 100,000M and obtain a loan of 200,000,M the equity is not constant, but falls to -100,000M.

It is the net worth that remains constant. That is what you need to calculate the leverage on. A “3x leverage” on equity is not a “3x leverage".

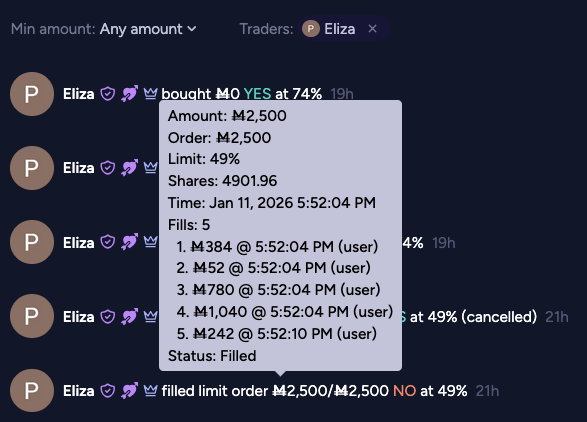

@travis I think one alternative is to place a limit order and execute it yourself, but I don't know how Manifold's math works in this case.

@travis Surely they don't let you reset your basis like that. That was handled in 2023. If you sell at a profit, that counts against your basis.

@Emanuele1000 Yeah, I noticed that example seems wrong. Taking out a loan doesn't keep your limit constant, it decreases your limit until you spend the cash.

@Eliza Well I'm looking at the spent/cost basis number on the market page. I sold all shares at a profit and it went to zero. Then I spent 50 mana on new shares and it went to 50.

@travis Wow, apparently they re-allowed basis resetting at the end of 2024. That's hilarious. No one ever announced that.

Why would they learn a valuable lesson in 2023 then throw it away and allow the same bad behavior a year later?

@ian what is the rationale behind allowing basis resetting in loans again after spending so much time and energy to get it turned off?

@travis correct me if I am wrong, but would the correct play here be to only initially bet one mana in markets one is interested in, and only put in more mana, once there are 10 traders?

@Emanuele1000 It looks like you're on the 1% tier but your daily loan was 1.06% of share value. I'm not sure what's going on there.

@JussiVilleHeiskanen I don't think the timing of your trades are relevant to the loan calculation. I'm thinking sometime overnight the system determines your daily loan for each market, then gives you that amount when you click the button.

edit: for instance, on this market I was the 8th trader, but eventually started receiving loans once 2 more people came in: /ac/how-many-oscars-will-sinners-win-at

@travis @Emanuele1000 Sh-sh-sh - there is clearly a bug, do you truly want to make enough noise for it to get fixed? :)

@travis I was thinking more in terms of increasing the counter in the market so it gets to that 10 trader level

@Emanuele1000 Yes something changed drastically, suddenly I'm thousands over my maximum, but without any drastic changes to my situation. I'm not even sure the loan total is correct

@JussiVilleHeiskanen Well you can only increase the counter once, so I don't see any advantage to trading earlier or later.

Update: once the midnight rolled over (or was there a further code update?), max loan amount computation seem to have improved - it no longer claims my max total loans amount is 0, it now claims it is equal to my amount invested - so there apparently was a change from total net worth (including mana on hand) to portfolio value (not including it). I do not have much mana on hand, but just enough to once again put me above the limit :( Very frustrating and annoying...

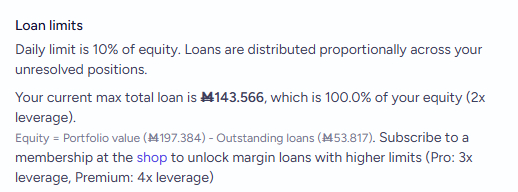

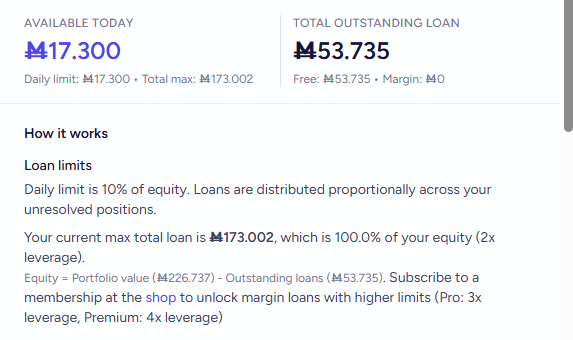

Your current max total loan is Ṁ120,599, which is 100.0% of your equity (2x leverage).

Equity = Portfolio value (Ṁ244,328) - Outstanding loans (Ṁ123,729).

@AnonUser The tragic thing is that I don't understand if this is intentional, to encourage investment and have a zero “balance,” or simply an error, and therefore in reality the 1% should be calculated on net worth, i.e., on “Equity” (or “Invested”), plus “Balance.”

@Emanuele1000 the message language is "equity" and "portfolio value", which makes me think it's intentional...

@AnonUser Yes, but they use AI, so it's possible that it's simply a solution offered by AI, without any reasoning behind it (so much so that Equity is also called Invested in user charts, which is the wrong word and also the wrong chart, what matters is Portfolio value).

@Emanuele1000 To clarify how incorrect the graph and the word are, I returned 5,000 Mana and “invested” increased by 5,000, even though I obviously did not increase the Mana invested.

But even using Equity, what information would a graph like that give me? At this point, a “Portfolio Value” that also contains also a “Outstanding loans” graph is much better.

@Emanuele1000 I haven't looked at it in detail, but the two of you seem to be describing a system extremely close to how it worked before this all happened. The "invested" amount has always been the value of your positions with loans subtracted out.

Money in your balance did not give you the ability to do any more loans. When people have complained about this in the past, they've been told to just live with it or invest the mana.

@Eliza Yes, it had long been suspected that “invested” was wrong, and now I have proof because 1. The value of the shares in my portfolio is indicated 2. I can return the Mana, thereby causing a significant visible change.

As for the second part, yes, I imagine it's intentional to encourage people to invest everything every day...

Money in your balance did not give you the ability to do any more loans

Before, the money in the balance already did not count towards the daily limit - fair. But now it also does not counts towards max total loans, which is a lot less fair - supposedly the max total loans is primarily to prevent people from going negative, and free mana is definitely should count towards that prevention. This is on top of the underlying issue that 100% limit is low and painful, not making it higher for Plus (heck, I can probably live with 125%) is annoying, and that as soon as things stabilized just a little bit, the limit was nerfed yet again is both painful and extremely annoying...

@AnonUser I've made most of the points you're making here in an appeal to the team back in December 2023 and January 2024. I believe the previous regime had allowed infinite leverage or something, and then some users crashed badly so they immediately went to a "1x" cap (or maybe they called it "2x", but I think it was similar to today's setup you are running into).

They ended up settling on 8x leverage and still did not take balance into account. No amount of persuasion tactics from me, @jacksonpolack, and @Tumbles was able to change anyone's mind!

I've carved this on a giant piece of granite and it is floating around in space as a memorial:

I think it's very important to note that in this current system, when someone asks why they're not getting loans, and what they can do in order to get some, the most correct thing to tell them is "spend your balance to buy positions in guaranteed markets, and you will start getting loans again"

@AnonUser

I guess there's no harm in trying again. Let me reformulate the same argument from before, you can read it and see if it matches the current system, then we can spam it around to try to gain momentum!

Account with 4000 mana buys 200 shares of Yes at 50% (100 mana spent) in 20 separate markets:

loanTotal= 0investmentValue= (200*0.5*20) = 2000balance= 2000

Over time, these markets continue trading at 50% and the user accumulates a loan of 50 mana in each market:

loanTotal= (20*50) = 1000investmentValue= (200*0.5*20) - 1000 = 1000balance= 3000The system calls this "2x leveraged" with

loanTotal+investmentValue= 2 *investmentValue

If the user had additional leverage available, they could continue gathering loans until they have 75 mana loaned in each market:

loanTotal= (20*75) = 1500investmentValue= (200*0.5*20) - 1500 = 500balance= 3500The system calls this "4x leveraged" with

loanTotal+investmentValue= 4 *investmentValue

If the user was to put 2000 mana in another market at 50% (4000 shares) at this point:

loanTotal= (20*75) = 1500investmentValue= (200*0.5*20)+(4000*0.5) - 1500 = 2500balance= 1500Now the system is happy, you get more loans!

Is that accurate for today's system, same as it was 2 years ago?

Doesn't it seem wrong that spending mana out of your balance magically enables you to get more loans on your existing positions even though you're probably in a worse position overall?

@Eliza My loan panel currently says:

Your current max total loan is Ṁ267,483, which is 100.0% of your equity (2x leverage).

So I think the leverage ratio is (loanTotal + investmentValue) / investmentValue. So I think it would be 2x in step 2 and 4x in step 3.

I'm on the 2x tier and currently at 2.1x so no loan today.

@Eliza I guess there's some idea that they don't want to extend loans to people who already have lots of cash and don't need them even if those loans are objectively safer.

@Eliza I thought the move away from cost basis was an improvement so I'm not sure why they reverted that. And yeah it seems like we're basically back to the old system except we're now capped at 2-4x instead of 8x.

@travis I think they're not safer because they might end up heavily concentrated in a single market. Normally (old system, anyway) there's relevant per-market limits that somewhat prevent that in some cases.

@EvanDaniel We should note that it took a considerable effort from multiple prominent users over many many months to get the per-market limit set up in the first place.

@EvanDaniel The loans will be safer because they can suffer a larger drop in their share value before going negative on their balance. That's assuming higher cash balances aren't correlated with more volatility in share value. If anything, I would expect the opposite correlation.

@Eliza yes. But my argument is actually simpler in a way:

For anybody actively trading in long-term markets, constantly hovering around the leverage ratio is an unavoidable fact of life

If free mana is counted for leverage, my strategy is: bank my loan every day, and spend it everytime there is a good investment opportunity - less than the daily loan amount on some (most?) days when nothing interesting happen, more on some days (for me, Friday evenings and weekends tend to be better than average as increased user activity creates more opportunities).

If free mana is not counted, the optimal strategy becomes: every evening, make sure to spend all mana, to max out the loan. When a particularly good investment opportunity comes along, swear at the stupid loan rules, then liquidate existing positions at a loss (reducing accuracy of those markets) to get liquidity, or pass on the opportunity (which reduces the accuracy of that market)...

Wouldn't it be better for Manifold to encourage the 1st stragegy rather than the 2nd? Would not it be a lot more fun for the users?

@Eliza actually, I am realizing it's even worse. I think I might be tempted to write a script that:

Finds a random out-of the way market with no recent trades or limit orders.

Dumps all free money into that market

Requests a daily loan

Immediately sells all shares bought in step 2...

(using a script to speed it up and minimize the chances of a bot betting on the dump market before I got my money back). I *really" do not like it - this site should not be about beating the site and gaming the rules, it should be about beating other traders!!!

@SG Is this what Manifold wants?

@AnonUser Yep!

It's important to note just how important the overall leverage ratio is to the practice of predicting on long term markets. The ratio is extremely harmful for users like you who are doing "exactly what Manifold wants" with long term markets. You're going to run into it after a certain amount of days, no matter what!

If it's 8x, that means there are more days and you can predict on a longer average-market-length timescale.

@Eliza True, I had missed that part. Taking out a loan not only increases outstanding loans, but also decreases equity, i.e., the maximum amount of loans that can be requested. In fact, if you don't invest, the maximum leverage is not 2x but 1.5x.

And on top of all this, there is also a 1% daily limit that slows down the achievement of leverage. The disastrous thing is that all this also applies to subscribers, simply with 2-3% and a higher maximum leverage, the effects are less significant.

Of course, I imagine that the site wants to encourage people to invest everything every day, but are you sure that encouraging people to invest everything every day increases retention on a site like this, which is not gambling but reasoning? Who knows.

@Emanuele1000 Previously, in 100 days you would reach a leverage of 2x (or at least, I believe that was the aim of the change; every day I could request 1% of a total that remained fixed before and after the loan request, so after 100 days I would reach 100% of that figure, i.e. twice that value). Now, in about 70 days, you'll reach a leverage of 1.5x, which is already behind schedule, and then you'll stop.

Of course, no one asks for loans and never invests, but that is irrelevant. In practice, there will simply be an intermediate value between the two listed above, depending on how many days you wait before investing what you have borrowed.

@Emanuele1000 Moreover, before in itself the leverage was higher because the balance counted, regardless of the fact that now asking for a loan decreases the maximum loan.

Previously, if I had 1000 M, I would invest 800 M and every day I would request 1% and invest it immediately. In 50 days, I would have borrowed 500 M and in 100 days I would have reached 1000 M.

Today, if I have 1000 M, I invest 800 M and every day I ask for 1% and invest immediately. After 70 days, I will have borrowed 400 M and in 100 days, I will still have 400 M.

The current system not only requires me to invest the entire loan I requested immediately, but also to invest the entire balance. I must not have any Mana available...

@Emanuele1000 To give a concrete example, previously, in 50 days I would have reached a leverage of 1.5x, in 70 days a leverage of 1.7x, and in 100 days a leverage of 2x.

With today's change, in 70 days I reach a leverage of 1.45x and stop there.

But in 10 days everything will change again and this whole discussion will be pointless. Not only is this site making several changes that are negative for me, but we are now on the fourth different change that revolutionizes everything in less than a month. Not only does it waste my time trying to figure out how to change my playing style, but after a week everything is canceled, wasting twice as much time...

@Emanuele1000 In fact, I just realized that I wasted about 45 minutes on this discussion. Not only are those 45 minutes that I could have spent using the site and betting on prediction markets, but they are also 45 minutes that I could have spent watching a TV series. These constant negative changes have robbed me of hours and hours of enjoyment, whether participating on the site or doing something else. I don't know how much longer I can take it.

@Emanuele1000 +1 I used to come to this site to relax and de-stress a bit. Now this site is adding to stress instead 😭

@Emanuele1000 There's a chance this might work. We need to invest everything, so if we find an opportunity we're out of Mana and need to buy some.

I might take another approach: Trade less in longterm markets and also less overall, and instead hold more balance and trade mainly by pushing 98.4% markets resolving in 2 days to 99%. Which will be more work and less fun and not what I came here for.

@Primer I did not follow the whole discussion, but I think the issue is with any per-account limit (as opposed to per market), because it discourages long term markets involvement. What is the basis is not that important.

Your approach looks very sensible, a pity it is not possible to bet under 1% / above 99%.

@Emanuele1000 I woke up today to a new change, never announced, which I only discovered when I requested my daily loan and noticed that it was a strange number.

Previously, the daily 1% was calculated on net worth, last night on equity, and today on portfolio value. I give up trying to analyze it, since it changes every day, but at a glance it seems to me that the lower leverage limit has remained the same (in my case, 1.45x), even if it is reached more quickly, in 50 days instead of 70 days.

I avoid trying to understand the intent behind these changes, unless it is to modify something at random.

@Emanuele1000 SG has said he makes changes just for the sake of making changes, because he thinks it's "boring" not to

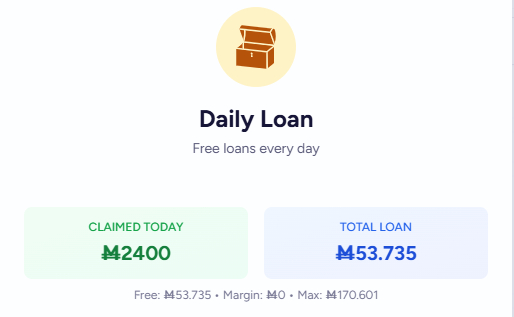

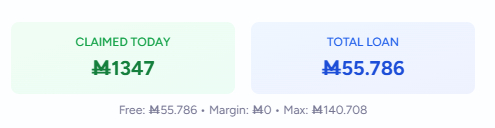

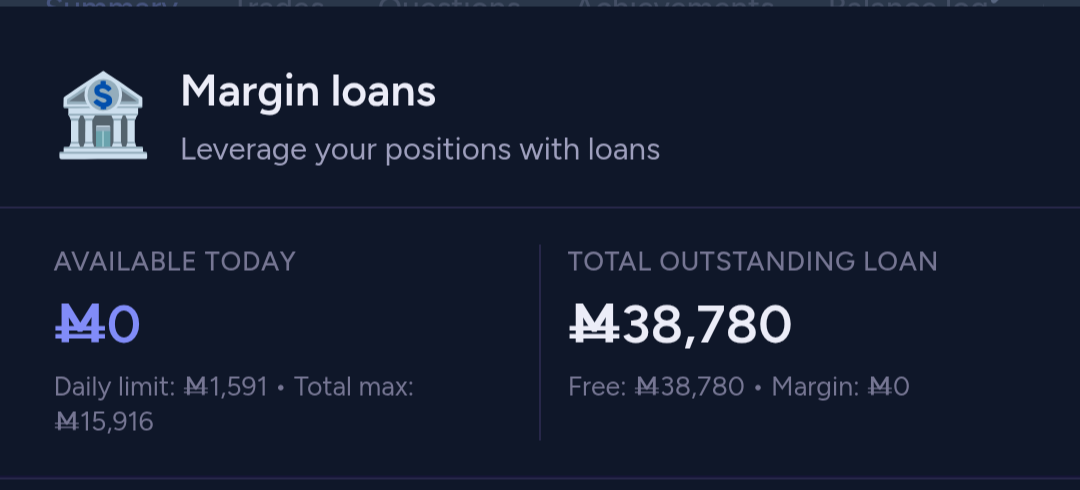

@AnonUser How the max is calculated definitely changed somehow (I claimed my loan this morning, but now my total amount of loan is more than twice the max)

That screenshot is for margin loans, but the free loans page has the same max

@AnonUser Someone pointed out the other day that the leverage was not calculated in a very normal way. I can only assume the AI botched the implementation of a fix.

@Eliza the claim in the commit message is that loans were being included in net worth, but that's definitely not true. What was the actual problem?

@ChurlishGambit The site has been running with less than 2.5 developers for almost a year by now. Almost everything has been done by AI for several months and especially the last 1 month.

@SimonWestlake The calculation of net worth used in this way has "always" included loans in the figure as far as I understand. So if you subtracted the loans another time you'd be into a weird territory.

@SimonWestlake @Eliza yes, last couple of days it seemed that the daily free loan was capped at 2% of my net worth rather than 1% it was supposed to be. Felt like a fair compensation for the recent mess :). Obviously the fix was botched :( @SG the new max loan computation is clearly wrong :(

@SimonWestlake the commit also states:

Free loans are capped at the invested amount (cost basis) per position,

in addition to the percentage of payout value

This is quite unfortunate :(. So now if you invest into highly volatile long-term markets, then you are really screwed... E.g. if half investments evaporate, and half doubles, you are now limited to only 50% loan, not 100% :( @SG is that intentional? Do you really not want people to bet on long-term markets?

@AnonUser yes, there was a bug with the loan implementation, which has now been fixed. Daily loans have always been capped by cost basis.

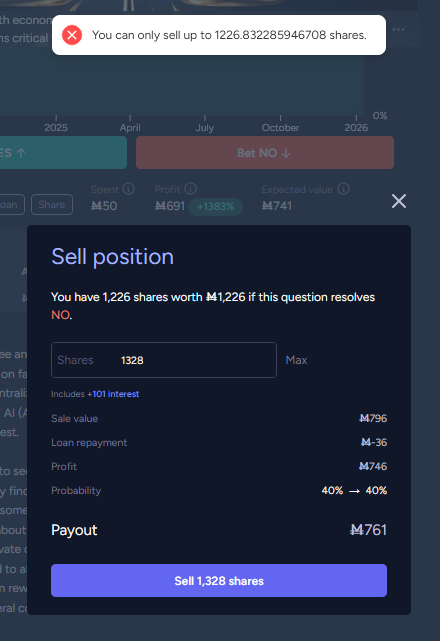

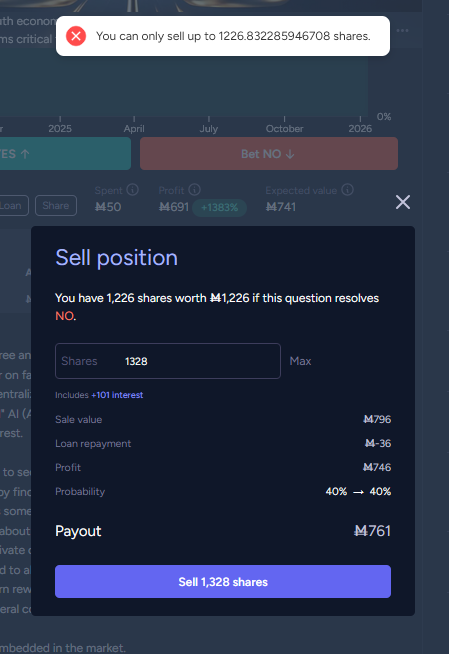

@SG so if I want a loan on something that went up. I need to sell it, and buy right back??? How is the cost basis calculated in I sell a position partially? How is that right now my total loan max is literally 0??? Including for margin loans????

@SG to be very clear - besides this being IMHO an extremely unreasonable policy, it is clear that it is also not implemented correctly

Available today

Ṁ0

Daily limit: Ṁ0 • Total max: Ṁ0

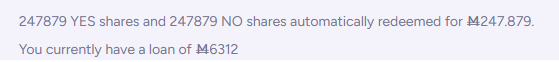

@AnonUser I have not looked in detail at the current system, but the loan program that existed from mid-2023 through the end of 2025 featured loans capped by the "amount invested" in the market.

This was a necessary step primarily to stop users from being able to do a basis reset by making wash trades. If your shares have appreciated and you sell them, then you immediately rebuy the same shares, your "amount invested" will be pretty low because you sold at a profit.

So, this is nothing new. You've "always" been subject to this restriction.

See this document for more information.

@Eliza but how is it that my max loan total loan is 0!? Surely that can't be intentional? A lot of my positions are in long-term swingy markets where I bought low and sold high, so does than mean that my cost basis is now very low, and I can't have any loans??? Does negative cost basis on one position subtract from my ability to take on loans in other positions?

@AnonUser My understanding is the per-market calculations are done separately from the total account eligibility checks for overall leverage.

But what would be the goal? To annoy users so much that they leave the site? What would be the point of using the base cost?

EDIT: In any case, I don't think the base cost has anything to do with it; the value of the shares is still used, not when they were paid for. In any case, it's still annoying because now, in order to take advantage of leverage, you have to invest everything every day. I guess it's a way to encourage people to return to the site every day and empty their balance, thereby encouraging the purchase of Mana?....

@Emanuele1000 I understand that it is programmed with AI, but at least there should be human oversight, otherwise it makes no sense. The “invested” field is actually “Equity.” Not only does it have the wrong name, but it is also completely useless as a graph. The graph should be Portfolio value.

Loan button good

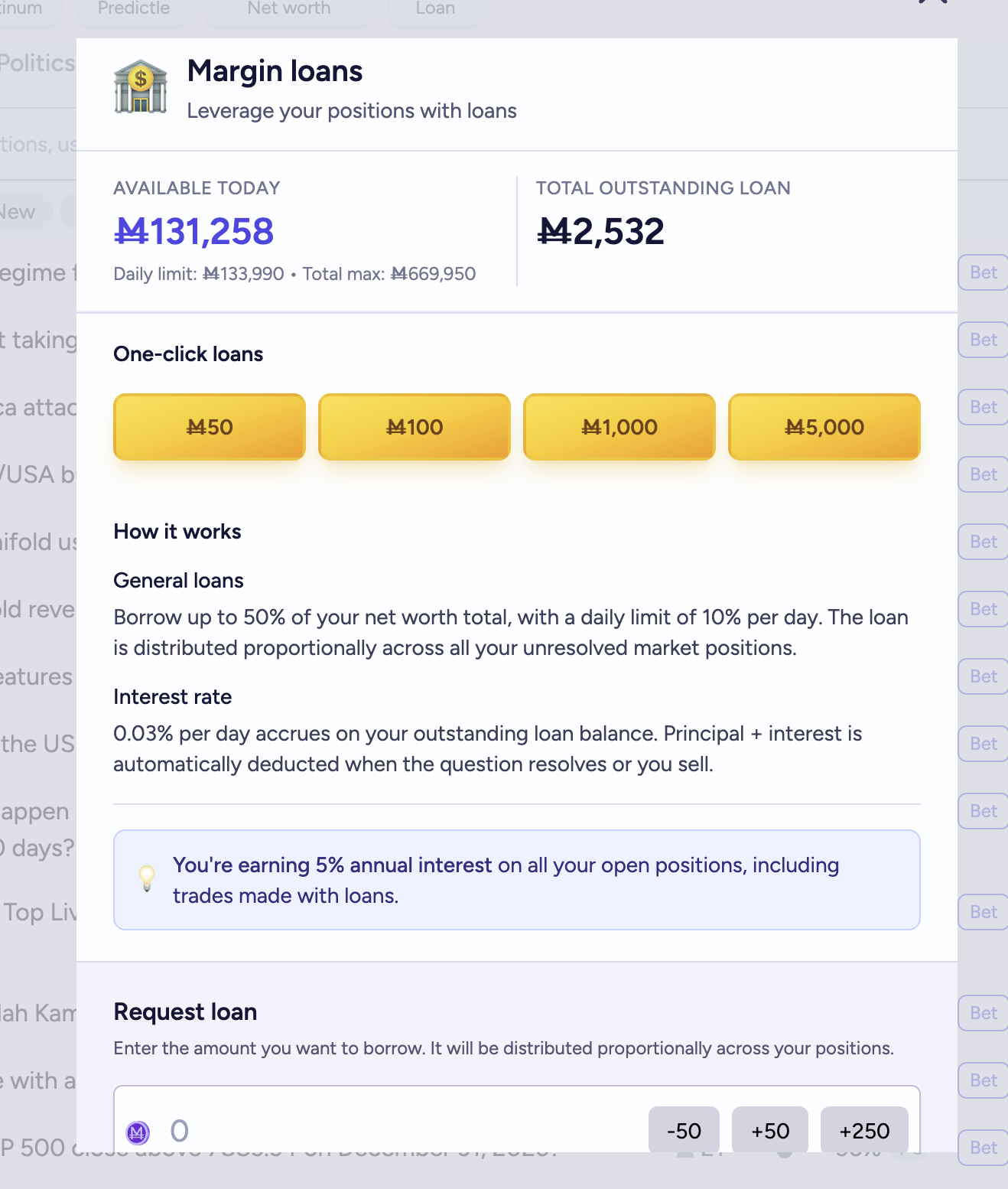

If you are a daily user, the 500 mana subscription level pays for itself as long as you do the daily quests each day and make at least 1 market per month

@ScottW Yes, the loan button on the Explore tab is good again. If you have a subscription, there's also a new loan button on your user profile for short-term loans, which is good as long as you only use it to make a (relatively) quick buck and then pay it off.

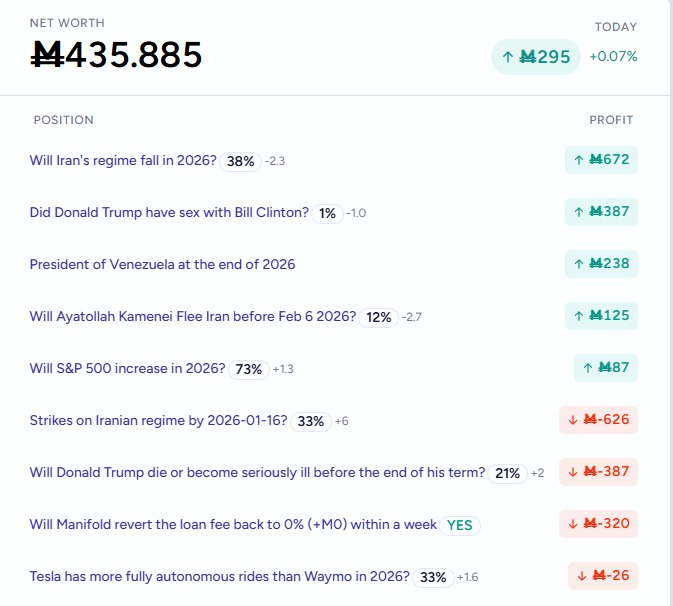

So effectively I ended up paying 50 mana/month for a star next to my name with the plus subscription... 50M because the 500M/month cost is getting offset by 15M/day extra in daily quest bonuses (50% extra of 25M trade and 5M share) * 30 days. I already have 12 streak freezes somehow that I do not expect to use up anytime soon, so the increase of the limit from 1 to 2 does nothing. The only other benefit is access to margin loans, which does not do anything for me, since margin loans are still inaccessible when free loans are at the net worth cap - it would require some very special one-off circumstance for there to be a day when my net worth jumps up by over 1%, or a big market closes and a bunch of loans are paid off, so that I cannot max out my loans with the free loan that day - probably only on New Year and election days (I mostly trade only US politics)...

@AnonUser there also should be 50% extra mana on the weekly quests as per the shop. So if you create a market using 100 mana a week, and receive 150 on the weekly quest, you net out to +164 mana per 30 days. I haven't created a market after getting the subscription but that's how it should work.

Essentially it's 32.8% return on investment (ignoring time value of mana). Or in other words the Plus subscription breaks even if you do all the weekly quests and at least 28 out of every 30 daily quests.

That's assuming you never lose your streak. I guess you still net out positive if you lose your daily streak once or twice in any 30d cycle but if you expect to be more inconsistent than that on Manifold then it'd be a good idea to cancel your subscription.

@SG it would be great if I got multiple notifications about impending subscription renewal 1-2-3 days before the next 500 mana deduction, if that's not already implemented.

Otherwise I may be

@SimonWestlake Found it. It's kind of confusing that it's on an entirely different page from the daily loan, but I get why.

@SG the subscription page has a big lie about the loan ratio - it says plus gives 2x increase in loan ratio, so I subscribed, but it seems it is still at 100% max??? :(

@AnonUser Also I'm not sure that the 1x 2x etc is being used in a way that's consistent with the 100% etc. I find the margin documentation pretty confusing at the moment.

@EvanDaniel 2x seemed clear to me as either 2x of the base account limit, or 2x over the net worth - which means the same thing, but it was all a lie...

@Emanuele1000 yeah, looking back, that's what they meant and the loan popup on the user page does say "Your current max total loan is Ṁ121,326, which is 100.0% of your net worth. Upgrade your membership at the shop to increase this limit (Plus: 100%, Pro: 200%, Premium: 300%).", but the subscription page made it extremely misleading... It looks like the subscription page now has the "Free" column too, but it did not yesterday :(

"Margin trading

Users can access margin loans at any time to borrow mana to trade with from your user profile"

@Velaris I am tempted to just quit the site altogether- I am here to have fun and de-stress, but now dealing with all these stupid changes that turn my past profitable-under-original-rules decisions suddenly unprofitable, having to stay on top of rule changes, and having to change my strategies to accommodate feels like a job, rather than a fun activity - and a source of stress, not an outlet for de-stressing. I do not need another job - that I am not even getting paid to do!!!

@AnonUser in my experience from the past they often stop the chaos after a few weeks. You've almost made it.

@Eliza Perhaps, but depending on where the madness ends, I might still end up stuck with most of my mana irretrievably locked for they next 2-3 years :(

@ChurlishGambit That's counter to my impression as someone who has been around pretty long. But they do care more about users with high balances.

@ChurlishGambit Yeah sure, this wasn't thought through enough, but they do think about these things, they do listen to user feedback. They break things, but they also fix things again. It's all very try-fail-iterate-ish, but it's not like there's SOPs for all this.

@Primer "They break things, but they also fix things again. It's all very try-fail-iterate-ish, but it's not like there's SOPs for all this."

There could be SOPs, if they cared. But they've made it clear they delight in this high-friction approach, & they loathe when people complain, & they mock people who don't like this intentionally & unnecessarily chaotic approach.

@Velaris What does trading long-term have to do with putting margin loans behind a paywall? You should only be using those for short-term bets. It's the free loans available to everybody that are useful for long-term bets.

@SimonWestlake They both provide liquidity, which is fungible, so the long term trade has an opportunity cost of "might have to take out a margin loan for the short term bet". The combo is still super useful if you're only occasionally low on liquidity, but they definitely are related.

@SG Still very much struggling against the 100% limit... Any chance it can be relaxed a bit? Perhaps at least by separating 100% max free from 100% max margin, rather than 100% max total?

For as long as I have been tracking (probably since mid 2025), I had loan to net ratio of roughly 125%, taking loans daily and almost always spending my balance down to 0 by the end of each day. Paid a bit down and got a bit of liquidity when a bunch of "will X happen in 2025" resolved. After the free daily loans became, I raised my "min edge to invest" by a factor of >2x (from 1.8% to 4%) to focus more on opportunities to liquidate my existing positions, reducing the loan balance further. Still my total loans right now are about 126K (down from 150K max at the end of December) on a 121K net worth, with liquidity down to M200. And I am staring at 5%+ returns on 3-year market, and no way to invest... (Of course, with 0.03% daily, 5% return over 3 years would still not be enough - but this is a sufficiently vilotile market that I could hope to not have to wait 3 years to be able to liquidate; still painful though)...

Hm, looks like with the new monthly subscription, we could now get access to higher loan-to-net ratio. Would probably get a plus subscription, except I now have a chicken-and-egg problem - no liquidity without loans, no loans without subscription, no subscription without 500 mana in liquid funds... And I already liquidated most of the positions I could liquidate within 0.5% or so loss...

@EvanDaniel I do bet on that topic quite frequently—like this one: https://manifold.markets/SG/will-manifold-achieve-breakeven-pro

@Eliza oh, I was wondering how I suddenly have 500 and able to subscribe - see it was your gift, so now understand the "fixed" comment :) Thank you!!!

@AnonUser Do you think you would make enough from the increased leverage to make it worth paying a higher subscription level? Or is the gap still too big at your net worth.

@Eliza I was making about 4K mana a month before. So unless the lack of liquidity reduces my income almost 2x (hopefully not), the higher subscription level is not worth it.

It smells https://en.wikipedia.org/wiki/Dark_pattern to present interest as "5% per year" and loans as "0.03% per day". It would be courteous to modify "Margin loans: Requested here. 0.03% interest per day." with a note that this is 11.57% per year.

It's nice that interest-laden loans are gated behind a relatively boring-looking button and form, except that the "One-click loans" section of that form has golden shiny-animated buttons to catch the fingers of people with shot attention spans. If such buttons are necessary, a nicer version would be colored a more poisonous/warning yellow, and be labeled e.g.:

Get Ṁ50 now.

Pay back Ṁ56 next year.

@Gurkenglas do you notice that the wiki example dark pattern image has 67 in it? is this coincidence 🤔

The banks have competition...

SHORT : https://manifold.markets/100Anonymous/test-6RttPSnlq5?r=VmVsYXJpcw

Update: We've removed interest payments again.

vs

Margin loans accrue interest at the rate of 0.03% per day. Trades made using loans are eligible for the 5% annual interest payments. So, the net financing for leveraged positions is ~5% per year.

?

Presumably the interest on loans should be reduced, so that it's back to 5% APY without the interest? (About 0.0135%/day rather than 0.03%/day)

@Eliza I think that with the total loan cap, we need the interest to preserve incentive to bet on long term markets.

Interest+Total daily loan cap is ok

No interest+Per market loan cap is ok

But total daily loan cap without interest just pushes people to invest in short term markets where the money+limited loans make the profit faster.

@Irigi I'm curious how the new payback for loans will function. It seems like you can get over 100% of your investment back within 100 days now, while the old system required a long time and you never got to 100%. So now I could invest in a 50 year market and have it all back "forever" after 100 days?

@Eliza Yes, but your total loan is caped at your wealth (2x leverage). So any loan you get, you get more quickly, but eventually you know you'll reach the cap. So better strategy is to invest in short term markets, where you realize the profit (including the leverage through loans) faster.

In the per market cap, you did not have to think about whether a new market you want to bet on is long term, as long as your investment was under the cap. Now you do.

@Irigi This is gonna sound really stupid but (not just asking you, but anyone):

If you came back for your next daily loan and the site told you that you were maxed out, would you consider buying mana (even for like 0.5s before you disregard it)?

So far I've never considered buying mana at any time. I don't think it would work for me yet but I kinda wonder if that would work for some people

@Eliza There's still the 5% NW cap per market, right? So it's hard to get to 100% on the daily loans. Except for ppl who deliberately optimize for that, and they're not the ones who will be disappointed when they hit the cap.

@Eliza I'm at my max loan and for the past few days (since the interest started) I've been gradually running down my balance. When I get too low for comfort, my first thought will be to trade less, my second thought will be short term loans (which I'll reject because I'm scared of the interest), then I'll think about selling out of some markets (tricky because most of my markets have substantial loans - and the one market with most of my mana is currently at a value where I'd be selling at a loss, even though I still think I'm right, which is an annoying prospect), and only then would I consider buying mana. I think I would consider it, but I don't think I'd do it.

@AhronMaline I wasn't deliberately optimising for getting large loans but it seems to have happened. My guess is it's because I've been using the site a long time and it just gradually built up

@Eliza TBH I don't want to buy mana right now or for the forseeable future. The struggle of optimizing mana by making good trading decisions is part of the charm of Manifold. Buying mana would feel like pay-to-win.

If the devs are motivated by money (can't blame them if true), a more straightforward donate-to-dev option like patreon etc. might make sense as a supplement to the option to buy mana.

Tangential suggestion - Maybe someone could officially set up a bank on Manifold. Offer 'trading leverage' or 'line of credit' based on 'credit history'. And offer interest on deposits. I might be interested in putting purchased mana in a bank.

@ChurlishGambit I don't mind paying a (really) small amount of money for things I actually use. Assuming this whole Manifold thing is built by a small dev team and isn't a hedge fund psyop lol.

Edit: To be clear I understand that:

1) not everyone can pay due to age or financial situation

2) creating a tiered system where paid users get benefits is not always desirable (but we already have 'buy mana')

@Eliza Probably not at all. I am using my mana as a tracker of how well I am predicting, but whether I have 100k or 1M is not that important to me, the relative change counts. I did the same on Polymarket: I bought some "entry money" and I am treating it as all I have. If I lost everything, I would either buy entry money again or left, with opinion I am not that good predictor.

I would consider paying some very small subscription (~1$/month), or occasionally randomly donate, with similar idea how I am donating to Wikipedia: to support a valuable service. But mana itself is not that important to me. (What is important to me though, is how the loan/interest system is affecting the prediction accuracy, because this is the main point of prediction markets).

@Eliza Maybe one more point: compared to how much mana I have, buying new mana is really, really expensive. There probably is a price at which I would be buying mana once I would run out of it, but at 10-100x more mana/$.

Daily bonus is 25M ~ 0.25$. That is 7.5$/month. If I wanted to buy at that rate, I would certainly expect much, much more than just to match the daily bonus.

@Eliza I am getting daily loans on positions that are underwater. I have several positions for which I would have to pay in order to sell any shares because the loans are greater than the proceeds.

I guess if you collect loans every day and have at least 20 open positions, you'll eventually reach the 100% NW cap and your daily loan will go to 0 until your NW increases.

@travis I still kinda feel like underwater loans should be clawed back at 1% per day rather than extended even further.

@Eliza Yeah, they could also just shift some of the underwater loans over to healthy positions. Or just lend against whole portfolios.

@ChurlishGambit How does that make any sense? You're arguing that Manifold doesn't have a viable business model, implying it will fail and disappear. Maybe so. But meanwhile we're enjoying it; and that includes you or you wouldn't be on here. So our interest is to keep it going as long as possible, and putting money into the "furnace" will help with that.

@AhronMaline I'm not "arguing" it doesn't, it's not something I'm making up. They've never managed to break even, much less profit, in the several years they've been running. That's not a viable business model, it's not a matter of argumentation.

The play money sales are not keeping it going, they're a drop in the bucket, particularly this past year.

@AhronMaline I did? Did you see "arguing" in quotes and just angrily mash your keyboard, instead of reading? Re-read my comment & try again please. Check the play money sales numbers on the stats page if you are unsure about how little cash they add.

@AhronMaline If you think the play money sales are keeping the site afloat, then you're living in your own reality & I can't join you there, sorry.

@marvingardens When you spent single digit hours on it, it's a lot easier to revert or recycle than it is when you spent five thousand man-hours on it.

@marvingardens I have a lot of complaints about how @SG has handled this and about the details of all of the various systems so far... but give credit where due, he does in fact sometimes listen to feedback and sometimes revert changes that are some mix of bad / unpopular, and a lot more quickly and frequently than many other places. It's a good thing and I appreciate it, and I think it's prominent enough that you'll notice it if you're paying attention.

@AhronMaline Yeah. compared to the original system, 25% is going to be a big barrier to betting on long-term markets...

@AnonUser I mean it's better than nothing... but yeah, not compared to the old pitch of "you get all your mana back in a couple of months"

@AhronMaline Looks like the 25% limit is gone!!! https://github.com/manifoldmarkets/manifold/commit/40ee63fa28afcb8f39ac38925629fd64ebf44b83

Currently the Summary -> Loans page says “💡

You're earning 5% annual interest on all your open positions, including trades made with loans.” But this post says that unranked markets don’t get interest. Can we get some clarity there? (Also I feel pretty strongly that unranked markets should get interest.)

@AnonUser One which is ineligible for leagues. There’s a few criteria, but if it’s self-referential, non-predictive, or purely gambling it’s probably supposed to be unranked.

@Hakari This comment is a great demonstration of why unranked markets shouldn’t be penalized any more than necessary. If they are, some people will avoid betting on them. If people avoid betting on them, there won’t be much incentive to make them. And the site will be less fun, and give people less reason to come back.

@Hakari of interest is paid in the form of additional shares it's impossible (I think) to profit by price manipulation, so paying interest on markets that are price manipulated is fine.

@SG looks like the interest-free loans are still capped? So still an opportunity cost in investing in multi-year markets that cause the loans to hit the limit?

@SG perhaps as a reasonable compromise the total limits on free vs margin loans could be made separate, so that maxing out on free loans does not automatically prevent people from getting margin loans?

@AnonUser I think the newly introduced total cap along with the per-market caps, are not that bad anti-inflation measure. It will allow non-whales to have enough funds to trade (and fix long term markets, of interests do not do that alone), while whales typically have enough money to go without loans.

@Irigi for as long as I have been tracking (a few months) I had loan to net ratio of roughly 125%, taking loans daily and almost always spending my balance down to 0 by the end of each day. Paid a bit down and got a bit of liquidity when a bunch of "will X happen in 2025" resolved. After the free daily loans became unavailable a little while ago, I raised my "min edge to invest" by a factor of >2x (from 1.8% to 4%) to focus more on opportunities to liquidate my existing positions, reducing the loan balance further. Still my total loans right now are about 130K (down from 150K max at the end of December) on a 120K net worth, with 9K of liquidity. And so even with today's change I do not think I can afford to invest in longer-term markets at much below 4% edge... I am a very active trader, but definitely not a whale...

@SG So now the loan is on 1% of the position, not the net position? Doesn't it become exponential?

EDIT: However, I wonder if, mathematically speaking, using the leverage of 1% daily loans, combined with the leverage of 100% paid loans, allows you to earn 5% annual interest, precisely by exploiting leverage... 5% per year, with a daily leverage of 1% WITHOUT exponential growth, means, I think, about 14% with an annual market. Or 23% after two years. But maybe I'm miscalculating something or I don't understand how that 1% is calculated.

@SG yay!

wait woah am I understanding this right, can you confirm that loans are based on position, not 'cost basis' or bet size? That would be really cool

@Emanuele1000 The daily loans are calculated from your portfolio value without loans, so it is not exponential.

@Emanuele1000 I'm not sure how it's actually done, but I think the right way to combine free loans + interest system is to:

pay interest on positions -- paid as additional shares

pay interest on uninvested mana balance

pay interest on the loan itself -- the amount due back later grows as well

That nets out to interest paid on net worth, in a way that's relatively hard to mess with by price manipulation.

@EvanDaniel Why would you pay interest from uninvested mana? I thought the whole point is to provide incentive to bet, no?

@Irigi Because thinking through the details matters, and that's where I end up when I try to consider what problems are being solved, what the second order effects are, and what is incentivized by each system.

The long-term opportunity cost that interest rates solve is the opportunity cost of doing something other than buying mana with your dollars. It doesn't help with the cost of investing in some other market, since those are equal. (For that you want to reduce capitalization requirements, and the daily loan system does that slowly which helps gently prioritize long-term bets.)

Paying no interest on balances just means people find a way to put the balance into an "investment" that isn't as real or interesting as you'd like.

Paying no interest on balances, but have loans grow at the interest rate, means you have to be careful how you handle the accounting. I'm not sure exactly how, but it sure smells like something weird breaks to me. And that weird smell has already identified 3 mana printing bugs in the new system, so I wouldn't deploy without some careful thought.

If you have interest on positions and not balances, and daily loans create loans that grow in size, people have to think carefully about whether to take them each day, which gets in the way of incentivizing engagement and makes the slow speed a drawback rather than a help. (Contra margin loans, which are great in the new system as best I can tell.)

And if you try to make the loans grow but not pay interest on balances but not owe interest on the piece of the loan that you aren't currently actively using... I'm not sure, it still smells a little funny to me, but only a little and maybe it works.

So when I add all that up, especially the part where Goodhart takes hold and your metric of "invested balances" suddenly stops looking much like "people doing interesting things with Manifold"... IDK, just do the easy math thing that treats people's mana like a real valuable asset and pay them interest. If you're trying to get them to buy mana with dollars, reducing the opportunity cost of doing so is a good approach, don't overcomplicate it by also demanding they invest that mana immediately and always.

@Irigi I have net positions of less than approximately 160k, but I received a loan of 1770M. But even if it weren't exponential, the doubt remains. I can ask for 365% in a year. With 5% interest, that means having the equivalent of 280% leverage, and therefore receiving 14% interest on the initial position, paying only 11% for the loan. Am I missing something?

@Emanuele1000 I don't know; I haven't seen a document describing the math in a level of detail I can use, so I'm guessing based on past discussions and stuff I've asked for before. At some point I'll go read the code but I haven't tried doing that yet.

@Emanuele1000 I believe the daily free loan is just 1% of EV (before loans) up to a cap of 25% on each market. I assume it's also subject to the overall net worth caps. You can't really use your account "invested" number to estimate your daily loan without subtracting all of your capped positions and adding back total loans. If this is correct, it means you'll hit the per-market loan cap after 25 days if the price doesn't change much.

@travis why do you say it's 1% of EV before loans? In the old system I thought it was 1.5% of EV after subtracting loans.

@AhronMaline I looked at a market where I had 2090 EV and 142 loan. Then I clicked the daily loan button, and the loan on that market went to 163. I'll check a few more when I click the button tomorrow.

@travis https://github.com/manifoldmarkets/manifold/commit/40ee63fa28afcb8f39ac38925629fd64ebf44b83

Looks like it's just the 5% NW now, no 25 day cap. So you could go for 100 days now?

@travis I'm not sure, I borrowed 1% of Ṁ195,600, which is roughly the value of my total position. If I excluded markets where the loan exceeds 25% (even considering the moment with the highest value), I would definitely have received less than 1% of 190k.

But perhaps there is still a limit of 100% of net worth, because asking for free loans reduces the number of paid loans you can ask for. Or maybe not, it's absurd that this basic information is not known.

@Emanuele1000 Well it looks like they're still tinkering with it. I guess the per-market cap is just 5% of NW now. I'm guessing my loan will be a lot bigger tomorrow because I have a lot of market loans that are between those two caps.

The "invested" number is calculated after subtracting loans (so NW is balance + share EV - loans). So the two adjustment I was suggesting work in opposite directions. I have 285k invested and 234k loans and I should be totally uncapped now. So I think tomorrow's loan should be either 2.8k or 5.2k.

@travis You're right, my mistake, that one always confuses me, so there could indeed be that limit you mentioned.

@marvingardens Same as the old daily loan, I think. You can see it spelled out more at the Loans button on the summary page, which is where you take margin loans now.

Does earned interest/accrued fees count as profits/loss (leagues/leaderboard/profile chart)?

When do accrued fees get charged, as a daily lump sum across markets, upon resolution, or otherwise?

Is there a way to show the loan amounts that are grandfathered in vs. those accruing fees, as well as the current (daily) and cumulative fees one is accruing/has paid? (per market and overall)

Thanks.

@SG for markets which are closed but not resolved for a long time, does interest stop accumulating at the close date or it continues to accumulate until the resolve date?

This version makes Loans usable again; the fees are low enough that it's worth taking Loans in many cases if you see a good deal. And the ability to take out up to 10% of net worth at a time enables that use case.

OTOH, I think it ruins the original purpose of Loans - to make investing in long-term markets worthwhile. The old system did that by making leverage hard to get - you had to wait while it drips in, and then you lose it when the market resolves. So parking large amounts of mana in long term markets (a bit more than 5% net worth in each...) really was optimal. With this new version, you can get the max leverage basically whenever you want. Long-term stuff has no real advantage, and therefore get killed by opportunity cost.

OTOH, I think it ruins the original purpose of Loans - to make investing in long-term markets worthwhile. The old system did that by making leverage hard to get - you had to wait while it drips in, and then you lose it when the market resolves. So parking large amounts of mana in long term markets (a bit more than 5% net worth in each...) really was optimal. With this new version, you can get the max leverage basically whenever you want. Long-term stuff has no real advantage, and therefore get killed by opportunity cost.

10x this!!!

that's why this change was paired with the 5% interest rate

Interest rate does not help at all - you get the exact same return whether you invest in a sequence of short-term bets or one long-term bet. But with the original loans, one long-term term bet gives you a lot more leverage than a sequence of short-term ones!

@AnonUser Also because, due to compound interest, betting on short markets is more advantageous for interest rates.

@AnonUser Interest rate helps with the problem that there is an opportunity cost for what to do with your dollars (instead of buying mana), not for what to do with your mana (betting in other markets). If there wasn't a peg to the dollar (one way or two way, doesn't matter much), it would be better (IMO) to try to run the mana economy in at zero interest rate. But, given that they care about people buying mana and having the ability to do so (which I support!), I think it makes sense to have an interest rate.

@AnonUser That said, the point you're making otherwise remains valid, and is why I think the free loans complement the interest rate. Both are good.

@EvanDaniel Are you suggesting people will buy mana for dollars because they want the mana interest... ?

@AhronMaline I'm suggesting that if people are thinking about buying mana for dollars anyway, they'll be reluctant to put mana into long term trades that don't earn interest.

@AhronMaline Basically I'm suggesting you should ask why Kalshi pays interest and thinks it's important to do so. The closer mana is to being like dollars, the more that argument will cross apply to Manifold.

@SG You could possibly give better interest rates for long term markets! But that isn't the case right now. The interest only incentivises betting as opposed to holding balance, not long term vs short term

@EvanDaniel On Kalshi the goal is to make money. Then it's true that you're competing against other ways to do that. Manifold is a game; money put into it is *spent* & not invested. People buy play money because they want to play with it.

@Hakari erm, but there's no limit to the amount of orders you have up at any given time. The mechanism of needing to have X balance to put up an order of X is fake. Just the vaguest suggestion on top of a system of unbacked orders.

@VitorBosshard Yeah I didn't mean ALL limit orders, I meant 'limit orders that are filled' should be rewarded interest from the limit order placement date, not the order fill date.

@Hakari ...ok, and this is still interest paid on something I can create millions of without the balance to back it up. It's weird in particular that you want to reward older orders more, when they're functionally identical to newer orders.

I'm not against somehow rewarding limit orders. but that would require an entirely different system of them.

@VitorBosshard you're being a little facetious right now. You can create millions of limit orders but (as I write this) the system is that interest is only paid on positions that were CORRECT.

So:

1) (Millions of?) Limit orders that were not filled wouldn't earn any interest.

2) Limit orders that were triggered but you didn't have the balance to back it up won't earn any interest.

Lastly, older orders are NOT functionally identical to newer orders. Orders should ideally be filled on a FIFO (first-in-first-out) basis. Let me know if this is not the case.

@SG Is this a larger or smaller motivation than that for 'improving the accuracy of long term markets' (or however you want to word it)?

because what you said here is a more believable rationale from your prespective than what you have said about the loan and interest changes up to here imo.

@No_uh my goals with this change are increasing platform accuracy and calibration, encouraging more site usage, and increasing fun. all three are important

@SG You've obviously got a lot on your plate right now so no rush but whenever it's possible do you or any of the other devs have any results from an overview you did showing that long-term markets were concerningly inaccurate? and if so, can we see those some time? or if anyone else reading this has data showing that manifolds accuracy on longer term markets (say, 1 year out from resolution) is bad, please share it!!

@No_uh an additional motivation is just novelty: i feel like the site has gotten a little stale recently and it's been a while since there's been a big change...

@SG Don't feel that way on my end (re: staleness) but you have a better bird's eye view than I!

re: things can always be better. I don't disagree. Just, if longer-term market calibration/accuracy was somewhat close to short-term, I would've expect more smaller granular changes than if it were a serious problem for taking the site seriously, a more novel approach or drastic change might be warranted.

Thanks for answering

@SG "an additional motivation is just novelty: i feel like the site has gotten a little stale recently and it's been a while since there's been a big change..."

Seems like a bad motivation to do anything in my opinion. Changes are more likely to make things worse than better on average. Most mutations are deleterious. Manifold is/was really, really good. Close to optimal. Hopefully this change will get us even better, even closer to the best the site can be, but the better the site gets, the harder it is to achieve that if your goal is partly "I'm bored; let's change something".

@SG can you add filters for 'listed' and 'ranked' in the market search/sort? I'm probably too new but I have no idea how to identify that.

@Eliza I don't know—& I'm not in the mood to do more free beta testing for the owners, at the moment, I'm sorry

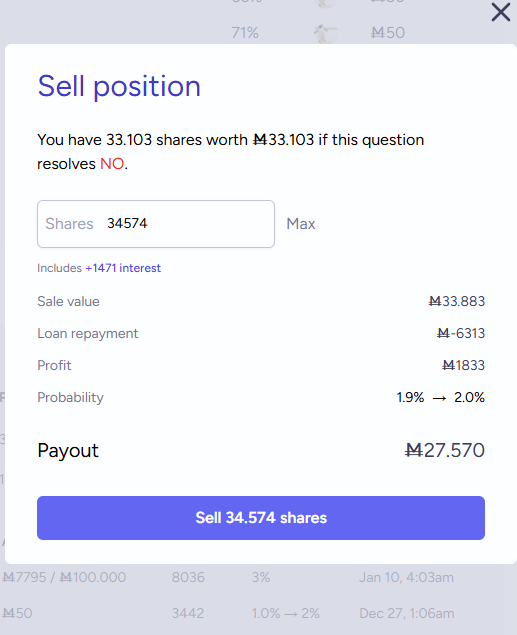

This seems more confusing than I thought. The interest is actually an increase in shares, but these shares do not appear on the main market screen (which causes me problems when I have limit orders to sell and have to click twice more to find out how many actual shares I have) and does not even appear as the value of the shares. Basically, if I sold the shares, I would have a net gain of 1,500M in my assets, which makes no sense...

@Emanuele1000 would it make more sense if there was a button "collect interest" to press which would collect your interest in shares but not sell anything. You would just increase the number of shares that you hold. Then you could transact as normal with your greater number of shares.

@Emanuele1000 And this goes against my interests, but I'm pretty sure that the interests are calculated incorrectly. The market has been open for two months, and to get 1,500M with 5% per annum, I would have had to have an average of 180,000M invested in that market, and I'm 99.9% sure that's not true...

EDIT: Perhaps it considers all purchased shares, even if they have already been sold?

@Eliza I may be missing something, but wouldn't it be simpler if 34574 shares simply appeared on the main screen as the main data, and consequently also the actual value of the shares I own?

@Emanuele1000 I am also seeing interest rates that are much too high in the same screen. I haven't tried selling yet.

@Emanuele1000 the way they implemented it is you have to do something to cause the shares accumulate because they can't drizzle them in one per second or one per minute or one per day.

@Eliza I'm not a programmer, but if the number appears every time I click on the sell button, even if I don't actually sell, couldn't that number appear directly on the main screen and influence the rest of the numbers?

EDIT: It would also solve the problem of compound interest, because as it currently stands, it is more advantageous to invest in monthly markets than annual ones (or at least to sell and buy back every month, if possible).

@Emanuele1000 Yep. But AFAIK it's "expensive" every time they want to show the new number. If there was a button to press to do the expensive thing, then you would have an up-to-date (within the amount of time you have been on the page) value of your share count at least.

@ChurlishGambit in the year of our lord two thousand and twenty six it takes compute time to calculate interest

@Emanuele1000 your confusion convinced me that the better ux is for interest to just be paid out at market resolution. if we could pay out interest early in mana (rather than shares), that would be good ux, but it's an exploitable mechanism. interest payments at market resolution is simple, easy to understand, and financially sound

@SG that makes sense to me as long as people who were right yet sold early will still receive interest at market resolution proportional to their holding time.

@SG No, I think it's the opposite. Payment in shares is much simpler and more intuitive. It makes it easy to understand that those who make incorrect predictions will not receive any interest, allows users to easily understand how much they have received in interest (it becomes practically impossible to calculate the interest you would otherwise earn, you would have to calculate the integral of your share balance multiplied by the value of the shares, which is not even data you have) and prevents users from receiving payments for markets in which they own nothing. The problem is that the interest in shares was on a hidden screen and did not correspond to the number shown on the main screen.

Furthermore, receiving interest in the future will effectively reduce that 5% per annum, but perhaps this is intentional to prevent compound interest. However, if that is the goal, simply choose markets that actually last less time...

@SG So if I hold for a year, sell, and then have to wait another year for resolution... I get paid a year worth of interest, but it gets paid late? Do I collect interest on that interest for that year?

Maybe another issue is that the further in the future the resolution is scheduled, the less likely I am to ever receive the interest payment (or be around to enjoy it). That's not a problem for the resolution itself because I can sell my stake in the resolution at any time. But I can't sell my stake in the accumulated interest.

@EvanDaniel it could be spicy but it's the time you most urgently need unexpected liquidity, and once the order goes through you can either take a quick profit or shuffle things around to pay it off quickly if you like.

The interest behavior is still unclear to me. Reading comments, I think it's actually working like this? Can someone confirm or deny?

- Imagine I make a question with 100m. We can imagine there's 100 shares in this market's liquidity pool (100 yes and 100 no)

- The cost to buy one of those shares in the liquidity pool (or the payout if you sell a share back into the pool) goes up over time, at a continuously compounded rate that ends up being 5% per year.

- Resolutions also take this compounded growth into account.

Is that how this is actually implemented? That makes a lot of sense to me, but... I'm not sure that's what is actually happening. It seems, at first glance, like that implementation should make it so you can buy & sell at any time, and get your interest correctly, right?

An alternative implementation I can imagine, which I think might turn out to be identical, would be for all share balances to grow by some small number every day at midnight or similar. The balance in the liquidity pool, the balance owned by each account, ... Each goes up. I'm not sure if that's actually the same or not, I think it definitely has different rounding behavior, but if you found some way to make it happen continuously, I guess it might be the same net effect?

Or are both of these completely wrong, and it's working some other way?

@DannyqnOht Well I'm also confused about the compounding because it seems like you can get more interest by regularly selling and rebuying your shares (forcing compounding).

@travis I don't think it works that way, they don't want you to compound. But try it out and see.

@DannyqnOht The way I undestood it is different: up until resolution, no interest is paid at all. Then at resolution, if the market resolves YES, then all past or present YES holders get a payment computed as

0.05*\integral (number of shares held) dt

Where t is given in years.

But this is just my reading; I agree it's not at all clear.

@AhronMaline They updated it, the post has changed slightly since the original version, specifically here:

If you sell out of a position early, you'll be able to sell shares from accrued interest as well.

@Eliza huh good point. Okay then I guess it must be the second thing Danny said - all share holdings grow continuously? Including the "fixed product" used by the AMM to compute prices...

Or maybe the Interest shares are "ghost" shares that don't affect the AMM prices, but can still be sold? And also don't earn interest themselves? That would mean you can gain by selling them to buy "real" shares at the same price, as Travis said

@AhronMaline I don't think the liquidity pools are changing, they all still show round numbers. Maybe they just pay that interest out at resolution.

@AhronMaline Well I thought holding 1949 shares for 56 days might have earned me 15 new shares (56/365) * 0.05 * 1949. But they only gave me 11, but in the discussion above they are seeing higher numbers than they expected.

@travis I found a market where I have held 614 shares for about 6 hours and it wanted to give me 41 interest. But I have done a lot of buying and selling in the past on that market so perhaps that is why it is confused.

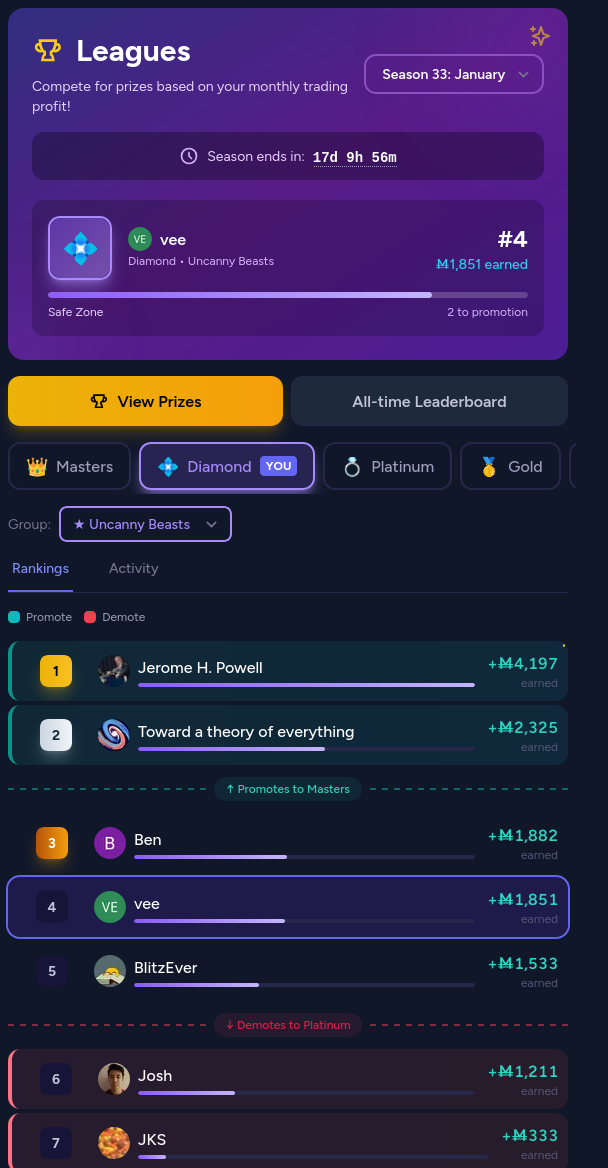

Leagues and rankings are already kind of meaningless, as small users must work much harder for the same absolute profit. This change makes the problem worse, as you're increasing the amount that new users have to invest to get on a competitive level with the big names.

What's the point of betting with a large vs a small balance? There is very little, other than a fake sense of accomplishment which is priced at tens of thousands of dollars these days. Insanity.

I bought $60 worth of mana back in the day, mostly to support the site, and it doesn't add to my long-term enjoyment in any way (it was a bit of a rush in the moment of course, but that was entirely fake and disappeared as soon as I recalibrated to my new net worth). All I care about is doing well, relative to my starting point.

I like the play money concept, it makes it more interesting and dynamic than metaculus (which feels tedious, while manifold feels like a game). But I think you guys are going about this the entirely wrong way. It's completely pointless to buy any amount of mana if it doesn't get you to a master level balance. So the business model is purely whale-based.

Looking at manifold from a game design perspective, it has all the worst features of gacha games. Achievement laundering. FOMO based sales tactics. Give free accounts an awkward trickle of resources, carefully making sure you can't have too much fun with them. Constantly rub in the pleb's faces how pleb they are.

Maybe mana should be deflationary rather than inflationary? Back when mana could be used for charity, I suggested that accounts should be forced to donate x% net worth every month, which balances user power over time. Those siphoned off winnings could then contribute to a "hall of fame" status you accumulate over years.

Alternatively, there could be "game modes" if you will, where I can start at an even footing with everyone else on the site. I'd be happy to pay $10 to participate in a seasonal league (3-4 months?) where everyone starts with the same balance, and maybe we restrict trading to a theme, or a curated list of markets. The mana from that league would then merge with your account once the season is over, so it'd be like buying boosters and drafting with them before putting them in you collection.

@VitorBosshard They already laughed me out of the room for the last idea, but I still stand by it. You need to use the phrase "colored mana" for maximal effect.

@SG That is true, and you're reducing my access to leverage. Furthermore, 1.5x leverage is very little when there are 4 orders of magnitude differences in net worth between users. It's still thousands and thousands of dollars of buy-in to sit at the big boy table.

But all of this is a red herring; I was talking about the new interest rate, and took that as a jumping off point to articulate some long standing issues I have with manifold's mindset.

Mana is funny money. No internal change to the mana economy will magically make it not funny money. My stance is that you should focus on the fun part, not the money part. Vaguely copying over economic concepts from the real world is pointless.

Of course I have no issue in general with tuning the mana economy to achieve various goals. I just don't see that the current changes will do anything, other than (1) increasing the pressure to spend for people who like to log in every day and bet on stuff and (2) raising the already insane spending standard for whales even further.

I'm here telling you (as a "medium" user) that competing with others is pointless and unfun. Spending $60 on manifold changed nothing about the fun for me. The way you sell mana is completely orthogonal to the way I enjoy the site.

Maybe some whales can buy fun for $10K; I don't understand the mindset. Good for them, whatever. But there isn't a sustainable business model there. You should sell premium features instead. If anything, the changes are way, way too conservative. You should be thinking about 10x more radical changes.

@VitorBosshard One question is whether we're trying to have the markets be accurate or whether we want them to be fun. Balancing user power (as suggested by you) makes the markets less accurate because the better predictors lose more mana over time. E.g. one could introduce a per-market maximum bet size like PredictIt has, which would make it more fun for new users, but also much less accurate. The best changes to the site would accomplish both objectives simultaneously.

@JonasVollmer fully agreed. I have tremendous respect for the difficulty of the problem, with multiple goals at odds with each other. But in the end, manifold is a business, and (I think?) these changes are aimed at making money, so that was my framing.

I hope we also agree that the current model isn't exactly great for market accuracy either, when people get a say proportional to how much money they're willing to burn for internet points.

At this point, it seems more realistic to get manifold funded as a non-profit, or changing the business model to sell something other than mana.

@ChurlishGambit live service games are a rock solid business model. The trick is to sell things that don't cannibalize the core product, to make the poors feel like they're low status but that they're still playing the same game as everyone else. This isn't just so the poors stick around to pump your DAUs. More critical is that if the thing you're selling can be construed as cheating, then it becomes low status, and then the whales aren't gonna buy it.

Fortnite doesn't sell stronger guns or increased movement speed, they sell emotes and character models.

For Manifold, mana is a core game mechanic. People with 1mio mana are playing a fundamentally different game to people just starting out. But a 1mio balance that you bought with dollars is not the same as a 1mio balance that you earned via trading. Thus, only newbies (and people feeling charitable) buy mana. No amount of macro economic fiddling can change this reality. This is a pretty disastrous business model because your most entrenched users are also the least motivated to spend any money.

To a large degree, live service games are in the business of fashion, of manufacturing desire. And the kind of people who would make a play money website may not necessarily do so well in the fashion industry. Unfortunately, that is where they've found themself.

@cthor Manifold used to have one "whale" (in the sense of spending money to buy mana). If someone invented the mechanic to attract just a dozen or so whales who are willing to spend hundreds to thousands per month on the game, they'd actually be in a really good position.

@cthor I mean I get it—the people running this place, don't. They've never managed to break even, much less profit, in the FOUR YEARS they've been running

5% is still really small. Why trade on a yearly market just for +5%, when I can trade on monthly markets which are equivalent to 12x my expected return on investment. This is only helpful for users who have <0.5% increase of their net worth per month.

If you want to be bold, you should make long-term markets high stakes. If a market resolves in a year, for example, both profits and losses should be doubled at the end.

@ItsMe If I am not mistaken, a 100% interest rate would probably make it even more inconvenient to bet on long markets. Because betting on an annual market would earn you 100%, betting on 12 consecutive monthly markets would earn you 160%, taking advantage of compound interest.

@Emanuele1000 it wouldn't apply to short term markets at all. It would be only long-term markets which are vetted by moderators. Each market would be given an appropriate stakes-factor based on how far away it is.

@ItsMe Well, of course, you could also decide not to give interest to those who have not held a position for at least 12 months (for example), but you are only shifting the problem. At that point, it is more advantageous to invest in five annual markets (you can double five times, so multiply by 32) than in a market that lasts five years (where you multiply “only” by five). Then, of course, at that point, I imagine that Manifold is not really interested in favouring markets that last 5-10 years over those that last 1 year.

@UnconditionalProbability How's it an incentive, though? You don't get the interest until later, & now your loans rack up interest all the time too. It's a restriction of the fake money supply, which is a disincentive to all betting

@UnconditionalProbability Considering that those who lose their prediction do not even receive interest, I do not believe that this will prevent people from going into negative mana.

@UnconditionalProbability Why does it incentivize long-term markets? You get the same interest rate on short-term markets. I think it just encourages people to keep a low mana balance. And it encourages ranked vs unranked.

Wouldn't it be simpler to just pay daily 0.00015 * invested portfolio or is that a different incentive somehow?

@Eliza Unironically a good idea. Subscription payments help cover risk of account blowup, people with a subscription probably care more about their account, harder to make a new account and resubscribe if you want to abandon it. Subscription plan should probably give you higher leverage available, though that should probably have both a leverage and an absolute cap...

@EvanDaniel Anyone paying a subscription plan to this site should be checked for gambling addiction lol

I do not think this is a good system. Daily loans were good, interest payments in any form are a mistake.

(I'm about to go out for the night so will write this very quickly & not edit it at all, oops.)

As background, to repeat from the other thread, there is no meaningful difference between balances & investments. Manifold is infinitely flexible, "ranked and actively traded" is an insufficient barrier, and it is still trivially easy to park your balance as a safe investment somewhere and accrue interest. I wouldn't even call it an abuse of the system—normally Manifold encourages finiancial shenanigans! So with minimal additional effort, I will store my excess balance as an investment, it will not induce me to do more meaningful trading (for whales, the limitation there is their own interest, not mana!), but Manifold will now start paying me 100,000 mana per year. I do not think this is a good way for the site to distribute mana.

While underspecified, I will assume that the motivation here is that the old daily loan system meant capital flowed a little too readily, and it would be good for mana to be a meaningful constraint for more users (encouraging them to buy mana). If that is not the goal, please correct me.

First, if the goal is to encourage people to buy mana, then inflation is a big deal. Interest payments are extremely expensive for the site. If I were a new user looking to buy mana, I'd be kinda confused that the site freely hands out $10,000+ in mana to old whales like me for free, and I'd feel like I was wasting my money paying the suckers $1 per 100M rate. Interest payments are extremely inefficient when it comes to motivating users! (They are subtle, no immediate feedback, etc etc).

Next, I recognize that it is hard to be certain what makes users want to buy mana. If you believe that some users will buy mana once they run out and reach the lower loan cap, then fair I guess. But I do not agree! Daily loans are very well-structured for the broader set of non-power users who might login to Manifold, place some bets, run out of mana, and then they'll come back the next day once a loan is available. Most of these users are not at all willing to spend a dime on mana, and that's unfortunate but inevitable, Manifold just isn't super important to them. But they are nonetheless important because Manifold only works with a sufficiently large userbase. Mana sales generally occur when some user wants a big burst of mana for something. These power users tend to be least sensitive to daily loans.