The largest exchange traded fund (ETF) in the world is the SPDR S&P 500 Trust ETF. The SPDR launched in 1993 and is tracks the top 500 publicly-traded companies in the United States (i.e. the S&P 500). State Street Corporation, which manages SPDR, has also manages industry ETFs.

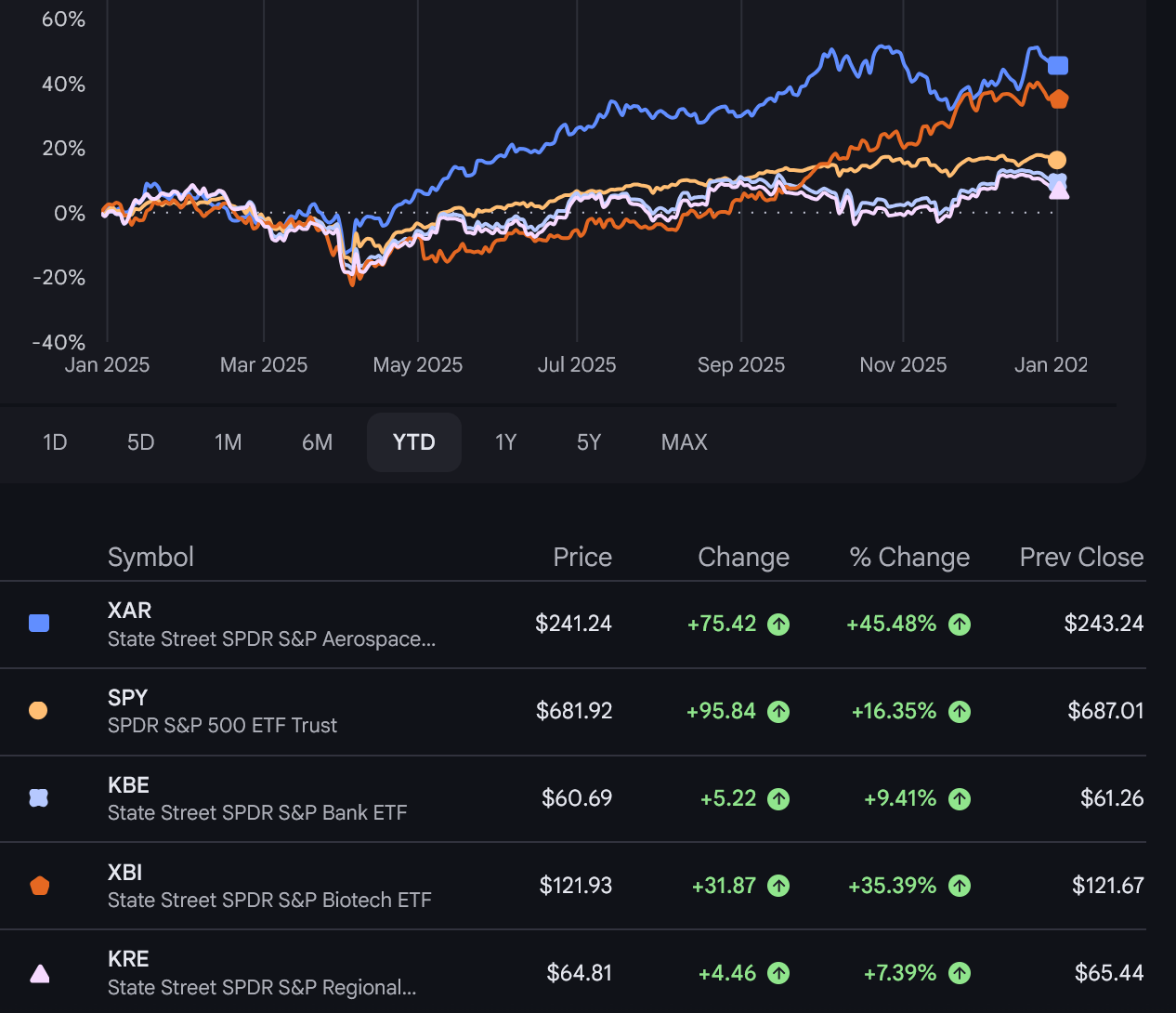

Which of these industry ETFs will outperform the S&P 500 in 2025?

This question resolves by comparing the YTD percentage growth of each fund at the end of December 2025 (e.g. as recorded on Google Finance) and resolving YES to the funds that grew by a percentage that is greater than the SPDR S&P 500 Trust's growth for the year (or if SPDR's growth was negative, then whichever ones lost less).

See also:

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ414 | |

| 2 | Ṁ298 | |

| 3 | Ṁ259 | |

| 4 | Ṁ178 | |

| 5 | Ṁ96 |

People are also trading

It's a bit confusing due to the way that tradingview does charting (aligned at close of x-axis) but this does indeed reflect the same as the YTD figures from google finance, which does not allow displaying as many tickers at once. In any case information to resolve all markets can be found in here, on the right hand side displaying relative gain/loss in price; I crossed checked the figures against the ones from google.

Here's a subset of the google finance YTD tickers you can cross check against, you can see they have the exact same values under % change column.