Resolves according to these markets:

People are also trading

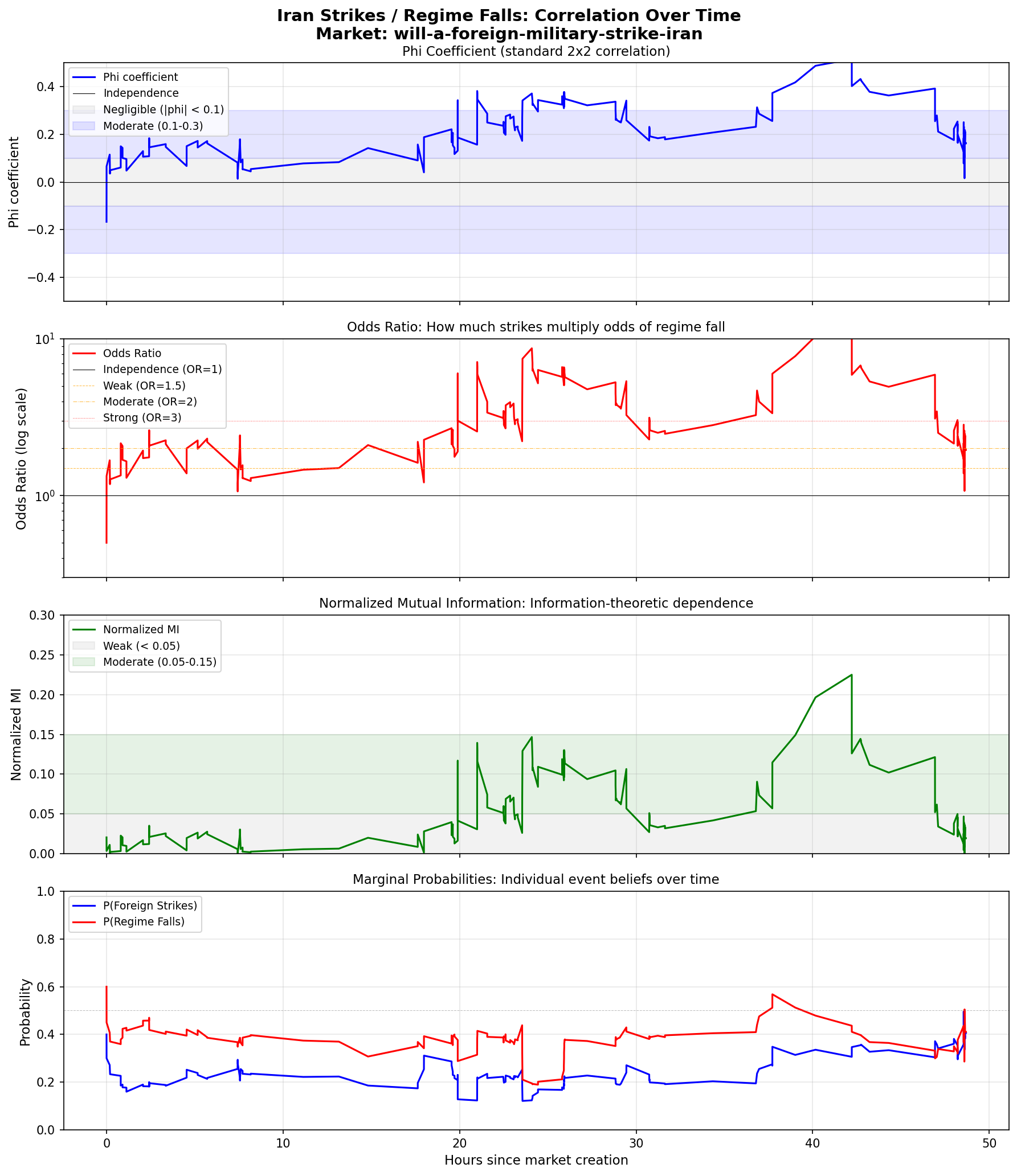

@skibidist An actual 5 year old is a tough audience :) But basically -- the graphs show how much traders think an airstrike will matter to whether the regime falls. Larger numbers mean these things are connected; near zero means they're unrelated. Odds ratio 2 is noteworthy. It means nothing is guaranteed either way, but it would be a huge impact.

Odds ration 2 means, roughly, "the regime is twice as likely to fall if airstrikes happen".

Over time, traders have varied their opinions not just about how likely the two events are individually, but also about how connected they are. We don't know why, but we could perhaps speculate; maybe some news events make people thing air strikes would topple the regime, and others that the regime is prepared to weather them. Maybe people have varied their opinions about whether strikes would just be something simple for show, or whether they would be part of a much more significant campaign.

@EvanDaniel Ok, I think I see the way you intend to use the math, thanks!

How does the math work? It looks like the bottom graph is raw data, and the top three are computed from it? How do you compute mutual info, odds ratio, or phi coefficient from the data? (I am sorta familiar with the definitions of the first two, don't know about the last; and let's assume everything I've heard about the first two is wrong :P )

It also seems like the math, if the top ones are computed from the bottom ones, can't distinguish between "air strikes cause regime fall" and "common cause makes both air strikes and regime falls". Personally, I bet the second one is what people are betting on, not the first. Am I wrong about it being able to distinguish, or is that accurate?

@DannyqnOht Yep, that's basically it.

There's no way to see causality in this data. Could be "strikes cause regime to fall", could be "people only strike at a falling regime", could be common third cause. You could look at temporal trends or try to build a more complex market with additional legs to show directionality, but that's a complex thing that I don't know how to do without some reading and very careful thought.

@EvanDaniel I was wondering the same thing. From the back of the envelope, OR is ~2 (strike vs no strike on regime fall). I honestly doubt mere airstrikes would have such a significant impact, in fact they could even create the opposite effect! (Rally around the flag like 12day war). The US can't create significant physical damage to the regime in the short run, mostly just symbolic damage. The only high risk-high impact option I see is assassinating the ayatollah.

Maybe the market is pricing not just these strikes, but them signaling further action by US/Israel later on, which would have more impact.

Edit: OR is 3 now!

@HenriConfucius yeah I assume "any strikes" correlates with "enough action to do something" and it looks like the market does too.

OR seems to be 8~12 now. The fact that the US announced its moving an aircraft carrier and it's fleet means that even if there's no strike today and tomorrow, the US could strike later on.

Also, they wouldn't move a carrier to the middle east for no reason. it's a super strategic asset. it's possible they'll attack intensely, maybe even blockade the country.

anyway, I believe this means no attack/regime falls is underpriced, attack/regime falls is likely overpriced. will be accordingly. thoughts?

@HenriConfucius "strikes a couple days later and the regime falls" definitely makes sense as a hypothesis!