Resolution Criteria

Resolves Yes if TSLA quarterly gross profit remains below $3.6 Billion in Q2 2025.

Background

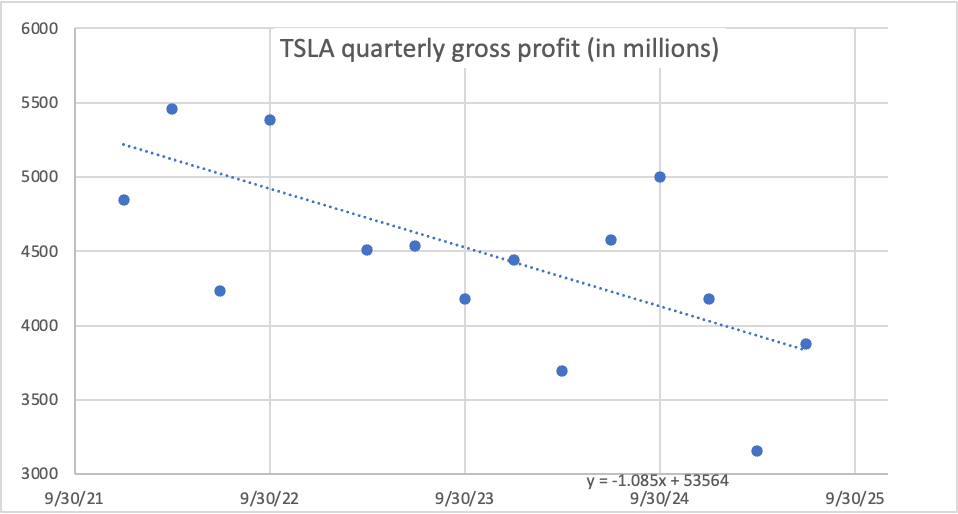

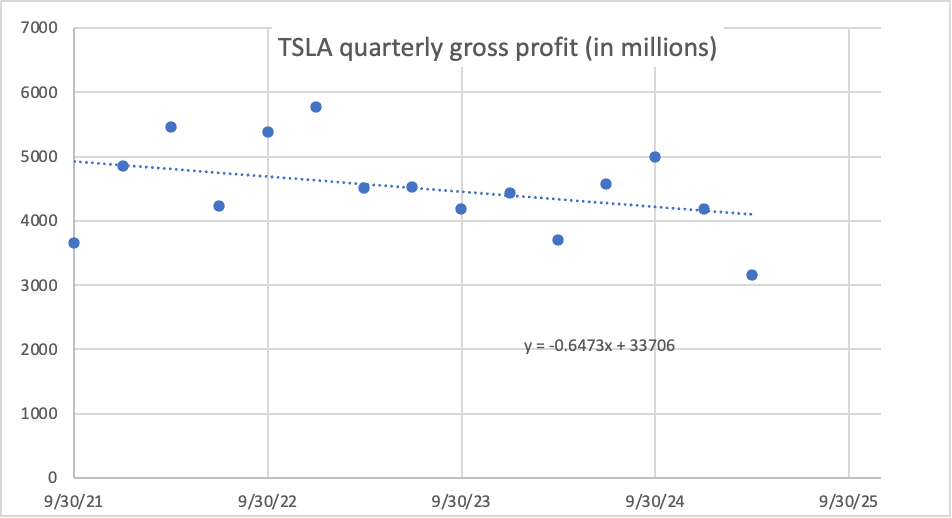

For 3 and a half years, TSLA has posted quarterly gross profits well above $3.66 Billion. In Q1 of 2025, gross profits broke below this barrier due to the damage Musk has done to the brand. At the Q1'25 meeting Musk pledged to spend a little less time in D.C. and promoted the conspiracy theory that protesters against Tesla are paid actors. Musk also said the changeover to the refreshed model Y affected sales.

If the changeover explains the drop, gross profit should return to historical levels. If not, Will this dodge fail to mend the brand image and fail to bring gross profits back above $3.6 Billion?

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ2,056 | |

| 2 | Ṁ1,530 | |

| 3 | Ṁ613 | |

| 4 | Ṁ504 | |

| 5 | Ṁ212 |

People are also trading

Oops. Read the description. This has objective resolution criteria. I should have read more carefully

I feel like this market would be trading a lot differently if the title was just, "Will Tesla's gross profits for Q2 2025 be above $3.6 billion?"

@jessald I should probably just shut up and let people keep feeding me but at some point...

80% certainty? Really??

@Eric_WVGG that’s not so undeniable. Tesla was making profit per car already before the EV credit. No other US manufacturer is turning a profit building EV. The EV credit did more to help Ford, GM, etc than Tesla.

@ChrisMillsc5f7 this question is not resolved on profits, it is resolved on "Gross Profits". Gross profits is revenue minus cost of making the product.

@Teddy well yes of course it is, but costs can be cut, numbers manipulated with one off items etc. So if the question is about sales volumes (also unclear, pricing changes too...) tje resolution should also be based on that. Anyway due to the issues I have l.flagged here I am not betting on this one. Declining sales volumes are a given though

@ChrisMillsc5f7 It includes cost of production, not operating expenses, so the cuts that you mention can be manipulated are not a factor.

This is a better measure of the Musk impact than sales volume since If the company drops prices to move more cars, the gross profit does not swing so much.

>"gross profits broke below this barrier due to the damage Musk has done to the brand."

This background is far more of a crazy conspiracy theory.

I admit there is some damage to brand (whether that is Elon's fault or the fault of crazy political POV pushing may be a matter of opinion).

However, the main reason was the changeover to the refreshed model Y. This both stopped production for several weeks at all their factories and resulted in people holding off buying model Y (the best selling car model in the world) in order to wait for the refreshed version and it shouldn't be a surprise if they are only beginning to ramp up production of the refreshed version that they didn't have enough of these to sell in q1 2025.

As to DOGE, one man waste is (or might be) another man's pet project. Are Democrats attacking Elon and DOGE rather than either attacking the waste and fraud being found or maintaining the things being cut are actually needed? Why are they attacking the messenger?

Edit: The background has been updated to now be more fair in giving model Y refresh shutdown as an alternative / extra explanation for q1 poor production and deliveries.

"This background is far more of a crazy conspiracy theory". @ChristopherRandles you have been drinking the cool aid. Why don't you pick up a copy of the Wall Street Journal to see that Musk tanking the brand is in fact main stream background.

@Teddy So I admit both are in play any you only mention one, and I am the one drinking the cool aid?

@ChristopherRandles No, you were not admitting both are in play - you said one was "crazy conspiracy theory".

@ChristopherRandles I added the refreshed model Y changeover explanation to the Background section. And I added a nice graph so you can see at a glance how 3.66 billion is an easy target if this explanation is correct.

@ChristopherRandles If you have any confidence in your statement

"the main reason was the changeover"

, you will bet this down well below 50%.

@Teddy I have now bet it down below 50%. Guess I should have bet it down more when I came across this market earlier when % was up at 82%.

Deliveries last 4 quarters 444k 463k 496k 337k. Q4 usually high and perhaps the ramp ups of refreshed Y are not yet complete so even if I thought it as almost all refresh and practically no brand damage effect I wouldn't expect it to bounce back up to 496k. On that basis, maybe 444k, same as q2 2024. So half way back up to that (444-337)/2 + 337 = 390k

Do I think over 390k vehicle deliveries is likely? Yes I think I do.

390 over 337 is a 15.7% increase. Your target 3.6B over 3.153B is a 14.2% so we are in the same ball park and me thinking the probability should be below 50% is fair enough, but that doesn't mean I should buy no to push the percentage far below 50%

Then there are other things that affect gross profit besides vehicle delivery numbers like selling price and margin. The trends here have not been good. This quarter might also be a bit weird due to tariffs. Perhaps early in quarter there is less pressure on margins as people expect price rises and want to get their purchase done before these take effect but maybe that applies more to other manufacturers than to Tesla and later in the quarter maybe not so much effect.

Anyway plenty going on which I may not understand so not wanting to take up large position.

What delivery numbers are you betting on?

https://manifold.markets/Prin/how-many-cars-will-tesla-deliver-in-A62g2cOCzz

I am betting on 425k or more and against under 400k.

You seem to have positions against 375k to 425k, I guess you can maintain you are not betting against higher numbers because the %ages are already fairly low.

@ChristopherRandles The 3.6 Billion threshold is lower than the quarterly gross profit has been for 3.5 years. 50% probability shows little confidence that Q1 2025 was anomalous.

@Teddy It is a tougher environment now than a few years ago when Musk was saying their margins were at crazy high levels. Margins are lower and there is more competition. "Little confidence" sounds about right, I could be wrong and lose mana on this one.* Grok seems to think 350-375k which sounds disappointing to me (particularly 350k which wouldn't show much rebound at all and mean brand damage dominated refresh purchase deferral effect) but it could be correct and the gross profit therefrom of $3.3B-3.45B, though I wouldn't be surprised if that varies with how you ask the question.

* That was before I made following decision:

Small guaranteed profit or take a risk? I decided to derisk

@Teddy I wasn't sure, but after reading your article I'm convinced Tesla sales are falling because of politics.