Resolves according to the budget speech itself, items will not resolve based on leaks or on information released post-budget, except in the case of a question which is difficult to resolve based on the speech which is clarified in supplementary announcements.

“Any increase in…” questions will resolve on any change that directly increases a tax rate, or changes to e.g. bands or eligibility. May resolve 50% if a change results in some taxpayers paying more and some paying less.

Update 2025-08-06 (PST) (AI summary of creator comment): The "Increase in VAT rate" option refers specifically to changes in the VAT rate itself, not to extending the scope of VAT to previously exempt goods.

Update 2025-11-24 (PST) (AI summary of creator comment): Resolution timing: Resolutions will be based on what is announced in the speech on Wednesday, with support from published materials. Resolutions may be delayed until Wednesday night or Thursday. In the event of a rapid u-turn, the market will resolve based on what is announced in the speech rather than what is voted on in the coming days/weeks.

🏅 Top traders

| # | Trader | Total profit |

|---|---|---|

| 1 | Ṁ968 | |

| 2 | Ṁ491 | |

| 3 | Ṁ243 | |

| 4 | Ṁ218 | |

| 5 | Ṁ132 |

People are also trading

I've resolved the Council Tax one after some thought. The logic to 10%:

- Existing Council Tax bands and structure are unchanged: leans strong NO

- New tax impacts <1% of homeowners: leans strong NO as most people would interpret this question as "is my council tax going up"

- new HVCTS has Council Tax in the name - weak YES

- new HVCTS is operated through existing Council Tax infrastructure - weak YES as @Roddy pointed out, that would likely be true of any mansion tax

And to consider a counterfactual: If this same tax had been titled "The Mansion Tax" I'd really struggle to argue that it should resolve YES based solely on sharing the existing infrastructure.

Curious to hear people's thoughts about leaving markets like this open for live trading. Personally I'm opposed (despite the fact I benefited greatly from it).

It's not like a sporting event, where there could be live swings but the outcome is still in question. It's just "who can respond most quickly to the information coming out without making mistakes". Maybe there's some interesting competition in the ability to rapidly interpret and respond to new information without making mistakes, but I'm not sure it's worth it.

The downsides are:

It's not really prediction

It's basically a transfer from the market creator's subsidy to the bettors' profits

It incentivises weak willed degens like me to procrastinate by watching the budget and hoovering up the free profits before anybody else does.

It makes it less trivial to assess "how accurate were our predictions"

Obviously it's entirely up to the market creator, and I'm personally grateful for the boost to my profits and protection from League demotion, but just wanted to share.

@Fion as a market creator I feel like it can be helpful in resolving if nothing else - I didn’t need to spend much time validating results, because the market ensured the answer was right.

I also feel like prediction markets fill a role as “answering a question to the best of our combined ability” and closing before the answer is known cuts that use case apart, because the market has the best answer until close and then it’s not actually the best answer any more until resolution.

I've skimmed the Budget 2025 document and I think resolved everything according to that, if you think I've got anything wrong then please flag it up.

The only one I'm conflicted on (and I'm guessing the market is, seeing as it's sat at 62% post-announcement) is "Increase in Council Tax". I'm tempted to resolve YES because the mansion tax is clearly named the High Value Council Tax Surcharge, however it also an entirely new payment that is not actually tied to the rest of the council tax system. Is it fairer to resolve YES, vibes% (probably 66%), or N/A?

@Noit yeah, I lean towards YES (biased but not that much). It's definitely a slightly non typical increase in council tax, and not what I'd jump to if somebody said "increase in council tax", but it is an effective increase in council tax for some people.

I'd respect NO or PROB as well, though. There are both "spirit" and "letter" arguments in both directions!

@Noit I don’t have skin in the game and feel like a <50% prob would be fairest. Arguments for yes: it’s called council tax, it’s administered by the council. Arguments for no: the money goes to central government not council and it doesn’t have the same bands system as council tax.

I feel like it was pretty likely that a mansion tax would be implemented with the council administering it. If most such implementations resolve this to YES then it’s weird it was trading lower than the mansion tax question.

Good morning @traders ! Just a few bits of housekeeping ahead of Wednesday:

I am attending a funeral on Wednesday, so I cannot play along live, nor will you be getting the rapid resolutions I did last year. I'm sure this is disappointing, but please do not chase on resolutions because I have more important things to be doing. I will try to get resolutions done on Wednesday night, but there's definitely the possibility that it drags on into Thursday.

I have dropped 5K of liquidity into the market, I hope this counters any disappointment you may feel.

On resolutions: these will be based on what is announced in the speech, with support from published materials to resolve anything that's less obvious.

The subtext of this is also that in the event of a rapid u-turn, I will resolve based on what is announced in the speech rather than what is voted on in the coming days/weeks.

I've extended market close to 9pm so that in the event of a delay to the speech I shouldn't have to step in to allow trading to continue.

Any questions, please get them in before Wednesday or be prepared for a delayed response.

@adssx https://uk.news.yahoo.com/reeves-set-increase-dividend-tax-200237511.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr

"It comes as part of a drive by Labour to ensure that income from wealth is taxed more equally to earnings made from work."

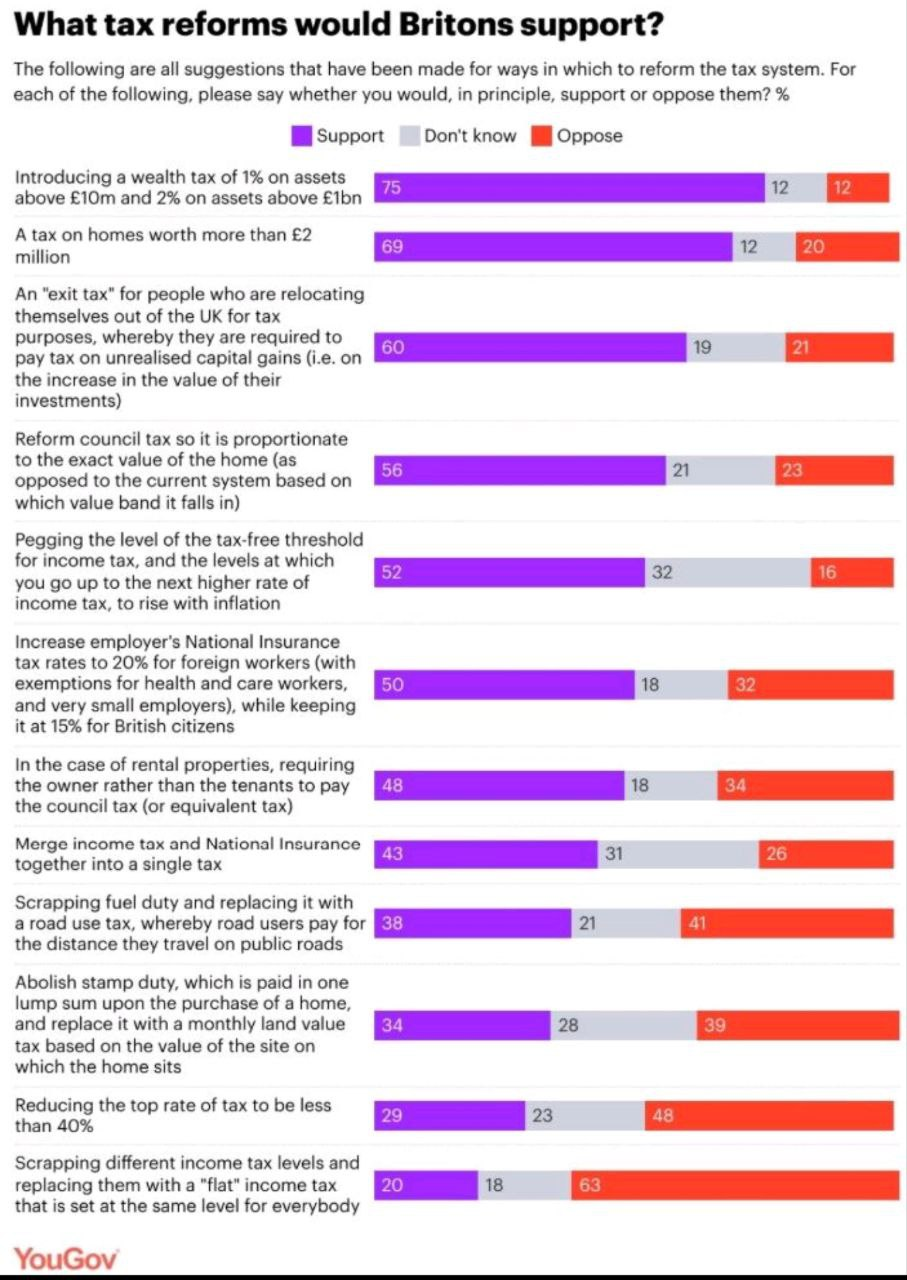

@Noit https://www.bloomberg.com/news/articles/2025-11-03/reeves-targets-uk-rich-with-exit-and-mansion-taxes-among-options

"Several newspapers have reported that Reeves is looking at reforming council tax to raise more revenue from Britain’s more expensive properties. That has led to suggestions that she is effectively considering a tax on mansions, a policy that has been popular with Labour members of parliament in the past."

@Noit could easily see this going either way. On the one hand, they need revenue from somewhere and it's a tax they've not promised not to raise, but on the other hand it doesn't raise much and it tends to upset people

@Noit can I clarify: would extending the scope of VAT resolve this YES? E.g. if some good that currently has 0% VAT was given the standard 20%, is that an "increase in VAT"? Or is it only if the standard rate is increased from 20%?