from dec 31 close to dec 31 close

People are also trading

Can you provide the exact starting price you're using?

Jan 2, 2026

Open: 6,878.11

Close: 6,858.47

Dec 31, 2025

Close: 6,845.50

@benmanns i’m not sure, the intent is to use the schelling point number, the one most financial professionals would find most sensible. As not a financial professional myself I reserve judgement for now. Is this your recommendation and if so where does it come from

@Bayesian I prefer clarity over any specific number. I like 2025 close to 2026 close, but tbh I'm not sure what is standard.

@Eliza yeah, not gonna happen:

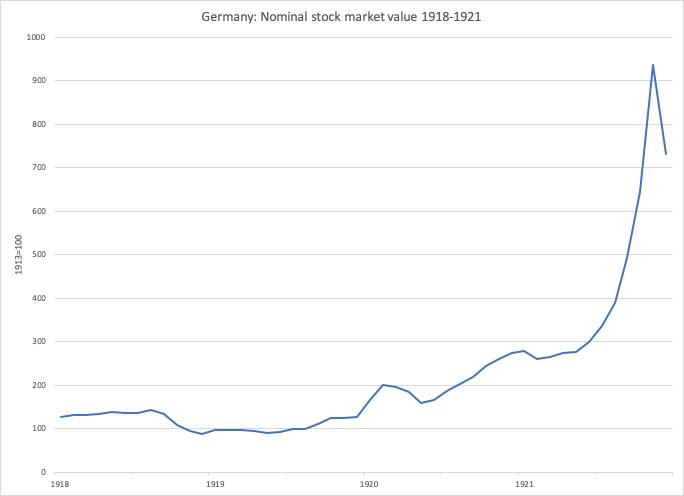

1) largest historical US stock market calendar year gain was 53% in 1954. base rate is 0%

2) historically large gains follow drawdowns like the great depression or COVID. the shiller CAPE, which predicts future stock returns (inversely), is the highest it’s ever been except the peak of dot com bubble

3) stock markets are forward looking and today’s almost unprecedented valuations already price in an AI boom

4) even if there is a dramatically larger AI boom than is priced in, this bet requires AI firms to capture that value, rather than it being consumer surplus from competitive pressures pushing profits to zero

5) even then it must be PUBLIC AI firms, and the odds of anthropic or openai going public seem low

6) even then non-AI firms make up >50% of SPY by market cap, so we’re betting on a >200% increase in all AI related firms if other firms do ~normally

i’m only not sinking my entire balance into this because the interest rate isn’t high enough

@jim ok good point but still not gonna happen

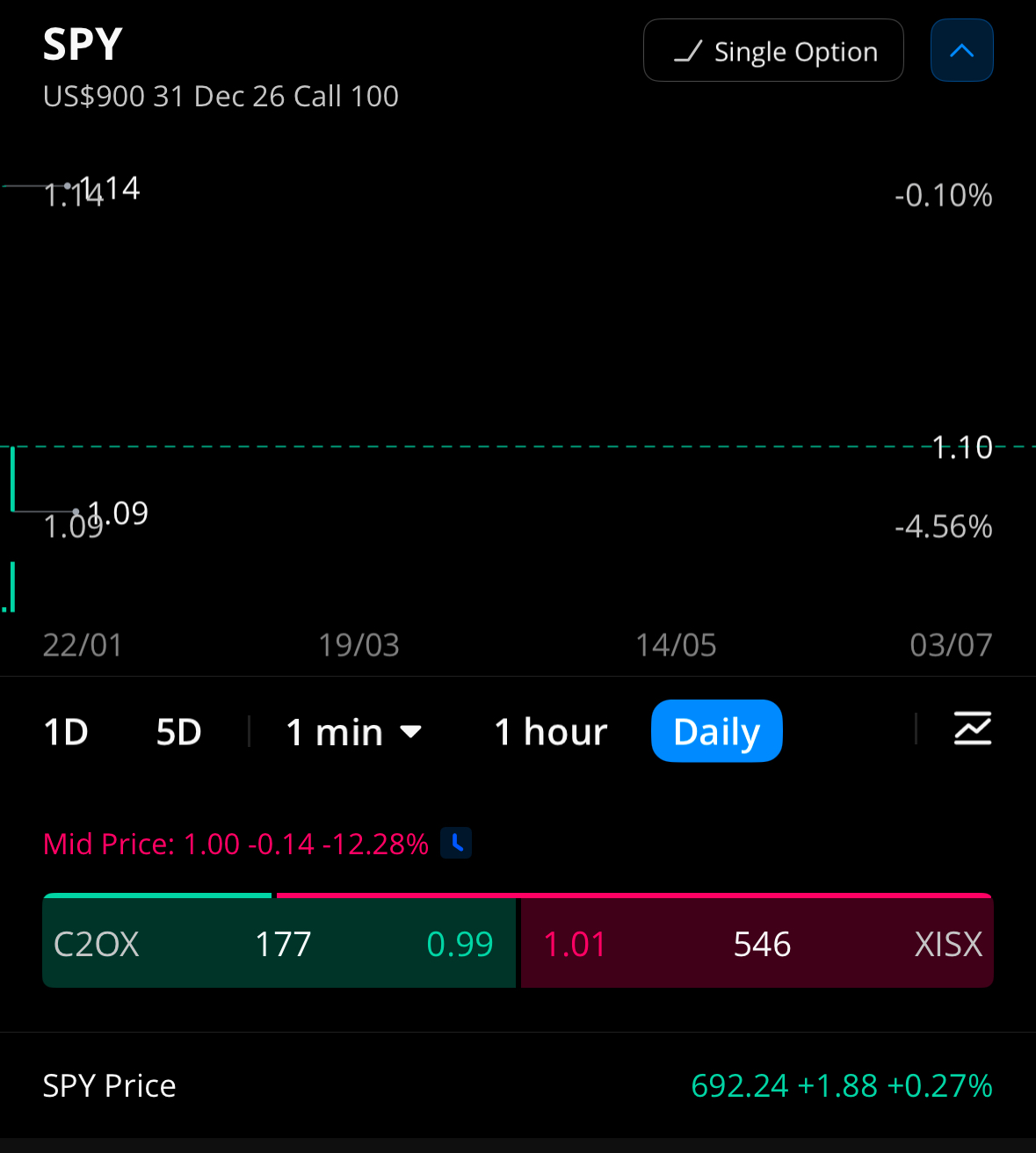

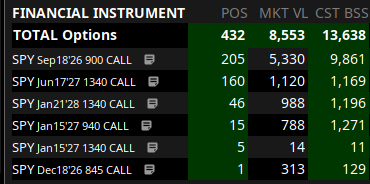

also $900 strike EOY SPY calls are trading for $1 per contract at the moment, you could 484x your money if SPY doubles from its current level. if 2% chance is fair these options are +900% EV

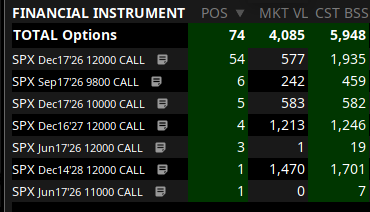

@brod i dont think spy / spx calls are an optimal investment atm but yeah they're very high-EV and i have some

@jim Because there's no apparent slow takeoff occurring yet. ;P

Edit: I have a limit order up for no at 8% if you want it.

😂

@jim depending on your exact definition I agree we might be in a slow takeoff, but it’s not obvious yet and regardless it’s still at earlier stages than 100% growth in a single year

@jim btw, if you’d like to bet more on this market, I’ve put up a 25k NO limit order at 3%. This expires in a week.