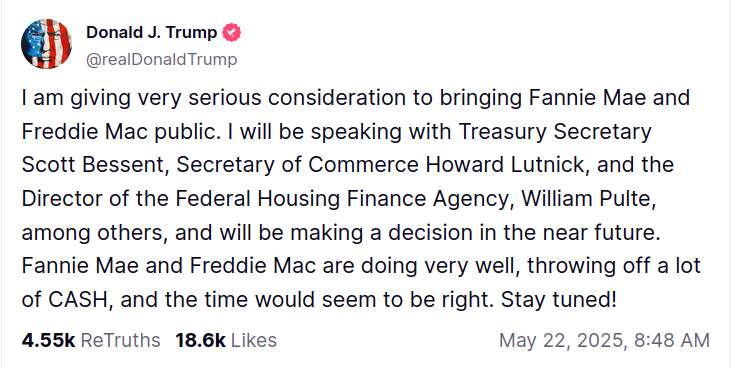

GSE exit from government conservatorship could enrich speculative investors in their common and preferred equity, including Bill Ackman who has loudly advocated for their release on Twitter. Privatization was a putative goal of the first Trump administration, but fairly little progress was made, in part due to large structural difficulties in accomplishing the goal, including the need for enormous amounts of capital to back the GSEs were they to go private. Some of those obstacles have lessened since the first Trump administration ended.

Fannie and Freddie's equity both trade in the mid $4 range at the time this market opened, compared to about $1 at the recent lows during the Biden administration, and $31 that Bill Ackman suggested as a most likely IPO price.

Resolution will be based on my personal judgement, and I will not trade in this question. Generally an event will count as a "YES" if it ends some or all of the existing government conservatorship and creates a clear path for private investors to be able to receive future cashflows resulting from the GSEs' future profits. Examples would include a "recap and release" plan and an IPO of the GSEs. If it becomes impossible for such a plan to be achieved by the expiration, I will resolve "NO".

Update 2025-11-13 (PST) (AI summary of creator comment): Ending conservatorship is NOT required for YES resolution. The market resolves YES if BOTH criteria are met:

Ends some or all of the existing government conservatorship - Examples that would satisfy this include:

Ending the Federal liquidation preference (e.g. deeming it repaid)

Giving the GSEs more freedom of action through lighter regulatory control

(These are examples, not an exclusive list)

Creates a clear path for private investors to receive future cashflows from the GSEs' future profits

A share offering/IPO is expected to satisfy criterion (2).

I am shocked this hasn't moved more, and if I hadn't already said I would avoid trading it myself for objectivity, I would be buying a bunch right now at 64% after Bessent's comments today.

It very much sounds like they are planning to IPO 3-6% of the company in the near term, which will be extraordinarily difficult to do without satisfying criteria for a "yes" here. Almost by definition it will create a clear path for private investors to get future cashflows. I don't see how they do the IPO without resolution of some parts of the conservatorship either. Those two criteria, to be clear, are sufficient for a yes.

@AbuElBanat There is now some reporting that they might do a 5% IPO without ending conservatorship. Please note that an end of conservatorship is NOT necessary for a "yes" on this question. The two tests for a "yes" here are (1) ends some or all of the existing government conservatorship and (2) creates a clear path for private investors to be able to receive future cashflows resulting from the GSEs' future profits.

I assume that (2) will be a very straightforward "yes" in a share offering of a GSE. What would count as a "yes" for the first criteria? I think an end to the Federal liquidation preference (e.g. deeming it repaid) would count. Giving the GSEs more freedom of action through lighter regulatory control would count. These are just examples, not an exclusive list.